Cryptocurrencies have quickly become some of the most talked about financial services brands on social media, but mixed public perception and a lack of trust in digital currencies and blockchain technologies remain potential barriers to their future adoption, according to a report released by social intelligence group NetBase.

NetBase’s annual report, which examined the trends and overall performances of financial services companies across social channels, highlights both cryptocurrencies’ meteoric rise in popularity as well as the realities of how that newfound awareness contrasts with current consumer opinion.

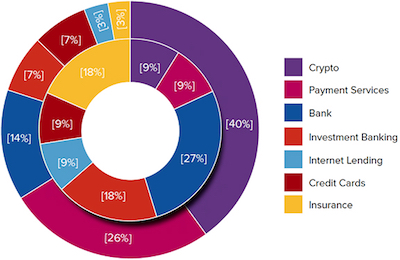

Even though cryptocurrencies comprised only nine percent of all the brands in NetBase’s analysis this year, it was responsible for 40 percent of the total social media conversation volume surrounding all financial services brands, beating every other financial category in the report, including banks, credit cards, investment baking, internet lending, payment services and insurance companies.

Share of conversation volume (outside) versus category representation share (inside) for financial services brands. |

By contrast, insurance brands made up 18 percent of the overall conversations covered in the report but represented only three percent of the total conversation volume. Banks comprised 27 percent of the brands included in this year’s list but represented only 14 percent of conversation volume. Investment banks made up 18 percent of the brands researched for the report, but represented only seven percent of the share of voice.

For the first time in the report’s history, two cryptocurrencies — Bitcoin and Ethereum — also made their way into NetBase’s top 10 Brand Passion Index for financial services brands on social media.

According to NetBase, American Express took the number-one spot. Paypal took second-place, followed by newcomers Bitcoin and investment advisor Vanguard, which took third and fourth, respectively. Goldman Sachs took fifth, followed by Ethereum, Samsung Pay, payment service Square, bank UBS and VISA.

When it comes to trust among consumers, however, cryptocurrencies leave much room for improvement. Bitcoin ranked second-to last in terms of trust in NetBase’s Brand Passion Index, above only Goldman Sachs. Fellow altcoin brand Ethereum ranked seventh.

Cryptocurrencies also scored below average in terms of net sentiment, which averages both the positive and negative consumer opinions of a brand. At 49.8 out of a possible 100, crypto ranked behind payment services, investment banking, insurance companies and Internet lending services.

Digital currency Bitcoin in December crossed the $17,000 barrier for the first time, having more than doubled in value since the beginning of November. The total cryptocurrency market now accounts for a year-over-year increase of about 3,400 percent — or about $563 billion — according to industry site CoinMarketCap.

NetBase’s “Social Media Industry Report 2018: Financial Services” analyzed the volume of conversation, awareness, reach, net sentiment and brand passion of 55 popular banks and financial services brands. Analysis ran throughout 2017.

Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management.

Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management. Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield.

Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield. Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office.

Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office. Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range.

Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range. Kekst CNC represents Grant Thornton as it sells a majority stake in its US arm to New Mountain Capital, which relies on Goldin Solutions, in what is billed as the largest PE investment in the accounting and advisory sector.

Kekst CNC represents Grant Thornton as it sells a majority stake in its US arm to New Mountain Capital, which relies on Goldin Solutions, in what is billed as the largest PE investment in the accounting and advisory sector.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.