More than half of U.S. total income in 2012 went to the top 10%, according to economists Emmanuel Saez and Thomas Piketty as reported in the Sept. 11 New York Times.

Income of the top 1% is now at the same level as before the Great Depression and the recent Great Recession.

"The economy remains depressed for most wage-earning families," said the article.

Other recent NYT pieces include "Poverty Rate up in City and Income Gap is Wide," "America's Sinking Middle Class," "and Rich Man's Recovery," by Paul Krugman.

Median pay of the top 200 executives was $15.1 million last year, said a Sept. 19 piece on SEC moves to force greater disclosure of pay.

New York mayoral candidate Bill De Blasio, playing up the income disparity angle, has soared to a 65-22% lead over Republican rival Joe Lhota.

We wore a suit and tie to work every day because there were so many lunches and other events to go to.

Lunch was at restaurants such as Lutece, "21 Club," La Grenouille, Four Seasons, La Cote Basque, etc., and often in the private dining rooms of the big ad agencies and PR firms. PR people entertained reporters at night by taking them to Broadway shows, symphonies and ballets. They had tickets to baseball, tennis, basketball and other sporting events. Golf outings hosted by companies, PR firms and trade groups dotted the calendar.

PRSA/NY Lunched at Waldorf

A highlight was the monthly lunch for nearly 300 at the Waldorf-Astoria staged by PRSA/New York. Top speakers were featured. The Society’s national president addressed the last lunch in June. National Investor Relations Institute had a similar monthly lunch. Publicity Club of New York hosted a meeting every Thursday night.

Numerous others in PR, advertising and journalism led the same kind of life. The rich in advertising and business shared their lifestyles. Businesses picked up the checks for 24 New York PR groups that we listed in the O’Dwyer NL of 9/24/75. Most of the groups welcomed press.

Almost all of them have vanished including PR Society: New York which dissolved in April after more than 50 years. The article listed many of the defunct groups.

Not only did business stop funding the PR groups, it also shut down expense accounts of individuals. A corporate PR friend had a $5,000 monthly budget for entertaining, publications, etc. He often hosted half a dozen reporters at lunch. He told his bosses they were not to question what he was doing with the money. PR firms, ad agencies and most companies had full-time people dedicated to building contacts with reporters.

Top Tier in PR/J Enjoy the Good Life

The milk and honey has not stopped flowing for the top tier in PR and journalism.

They attend more than a half dozen banquets during the year at which tickets range from $350 to $1,000.

Arthur W. Page Society’s Spring dinner is $395 per member, $595 for a guest, and $3,500 for a table; PR Foundation’s Paladin dinner in April is $450; Council of PR Firms dinner Oct. 23 is $625 for members, $1,000 for non-member and $4,950 for table; Committee to Protect Journalists dinner Nov. 20 is $1,000 per seat; Institute for PR dinner Nov. 21 is $500; the "Financial Follies" of the New York Financial Writers’ Assn. Nov. 22 is $400 ($3,500/table).

CPJ awards banquet in 2011. |

At our request CPJ gave us a ticket to its 2011 banquet at the Waldorf-Astoria and we showed up in black tie as required. But rather than finding a seat on the ballroom floor, we were sent to the balcony where dinner was sandwiches and potato chips. Not allowed on the floor, we watched the proceedings from the balcony.

PR Seminar, PRSA Also for Elite

Another top tier group is PR Seminar, the annual gathering of about 150 corporate and a few PR firm executives at the finest resorts in the U.S. Registration is $3,500 and four nights of lodging and food as well as transportation can equal that. Weighty topics are discussed in between golf, tennis, side trips, banquets and other activities. Addressing the 2013 Seminar at the Ritz Carlton at Half Moon Bay was retired general Stanley McChrystal, who lost his job as head of U.S. troops in Afghanistan after a Rolling Stone article in 2010.

Present for the 2011 and 2012 Seminars and probably for the 2013 meeting was Richard Tofel, who has succeeded Paul Steiger as president of ProPublica. Steiger, who has also chaired CPJ, had total pay of $584,914 in 2012 while Tofel was paid $363,600 as treasurer, secretary and general manager. Both were at the Wall Street Journal for many years. Six other ProPublica staffers made more than $200K in 2012 making them among the highest, if not the highest, paid journalists.

ProPublic rebuffs our efforts to interest any of its 40 reporters in the press policies of the PR Society. It also does not report the existence of PR Seminar.

The Society’s annual conference, set for Oct. 26-29 this year, is also for those with hefty expense accounts since registration is a minimum of $995 in advance ($1,275 now and $1,575 for non-members). Only about 4% of members go to the conference, leaders have said. An attendance list last year had about 1,500 names but this included non-members, exhibitors, Society staffers and press. The more than 20 ex-Society chairs get free conference registration for life as well as free national membership. Eight staffers make more than $100,000 topped by COO Bill Murray’s $382,013 in 2011. The Society is withholding IRS Form 990 for 2012 which has that year’s pay packages.

Where Did the $$ Go? OMC, WPP, IPG

Ad conglomerates Omnicom, WPP and Interpublic, having bought up almost every sizable ad agency, went to work on PR starting around 1980. Acquired were 19 of the 25 biggest firms as ranked by the O’Dwyer Co.

The conglomerates, being publicly-held, pinched every penny. One of the first places they looked were the ad/PR clubs and PR expense accounts.

More than just saving money is on their minds. People who gather are likely to start talking about their bosses and the eye-popping pay packages of the conglomerate administrators, none of them from the creative side as far as we can determine. The PR groups are like mini-unions, in their eyes. If PR people want to meet, let them pay for it themselves, is their attitude. The numerous lunch groups quickly dried up. Publicity Club of New York met every Thursday night for many years but that also vanished.

John Wren, CEO of OMC, and Randy Weisenburger, CFO, took home $53.3 million and $31.5M, respectively, in 2012 or a combined total of $84.8M (including net proceeds from stock sales).

WPP stockholders, angered at CEO Martin Sorrell’s take, forced a cut of 20% in 2012 and plan a 34% cut in 2013 relative to his 2011 pay.

His 2012 pay was $28.2M, up 47% from the previous year. Sorrell in some years is the U.K.’s highest paid executive.

IPG Has 58 Pages on Pay Plans

IPG CEO Michael Roth had total pay of $9,663,294 in 2012, according to the proxy statement, which included $1.4M in salary; $3,362,388 in stock awards; $2,331,191 in option awards; $2.1M in non-equity incentive plan compensation; pension value of $57,285 and "other" pay of $382,430. He sold 324,341 shares at $11.20 for $3,632,619 on April 2, 2012. His package in 2011 was $12,983,942.

He sold 347,096 shares on April 1, 2013 at $12.90 for a total of $4,477,530.

As of April 2, 2013, he owned 954,336 shares and had options exercisable within 60 days on 3,454,443 other shares.

Krakowsky |

IPG’s description of its pay schemes total 58 pages and are no doubt what the SEC has in mind when it calls for simplification of such schemes. The most recent plea in this regard was unveiled Sept. 19.

Ex-PR Head Krakowsky at IPG Top

Philippe Krakowsky, who used to lunch with us when he was PR director of Young & Rubicam from 1996-2000 and even after he joined IPG, has become one of the top five IPG execs as XVP and chief strategy and talent officer.

His pay package was $3,290,492 in 2012 and included salary of $754,167; bonus of $166,225; stock awards of $1,132,262; non-equity incentive of $833,775; pension value of $335,525 and other of $68,538.

He owned 240,498 shares as of April 2, 2013 and had options on 222,623 shares exercisable within 60 days.

He sold 125,000 shares on May 1, 2013 at $13.73 for $1,716,250 after selling 135,144 shares on April 1 at $12.90 for $1,742,841.

IPG’s stock was $17.28 as of April 20. It was as high as $58 in 2000 and fell to below $4 in 2009.

AB InBev has hired Donna Lorenson as chief communications officer and elevated the PR function to the senior leadership structure in the aftermath of the Bud Light marketing disaster.

AB InBev has hired Donna Lorenson as chief communications officer and elevated the PR function to the senior leadership structure in the aftermath of the Bud Light marketing disaster. Tunheim handled the Minnesota USA World Expo bid committee, which on June 21 congratulated Serbia for landing the 2027 event.

Tunheim handled the Minnesota USA World Expo bid committee, which on June 21 congratulated Serbia for landing the 2027 event. United Minds, management consultancy, has launched Myriant, a business resiliency offering to help clients deal with the challenges during this era of misinformation, polarization and geopolitical upheaval.

United Minds, management consultancy, has launched Myriant, a business resiliency offering to help clients deal with the challenges during this era of misinformation, polarization and geopolitical upheaval.  ImageShield, which guards against online image abuse, is looking for a communications pro to handle its PR and marketing campaigns.

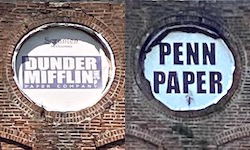

ImageShield, which guards against online image abuse, is looking for a communications pro to handle its PR and marketing campaigns. Who knew that there is a real paper company, Pennsylvania Paper & Supply, inside the iconic building seen at the opening of every episode of “The Office?”

Who knew that there is a real paper company, Pennsylvania Paper & Supply, inside the iconic building seen at the opening of every episode of “The Office?”

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.