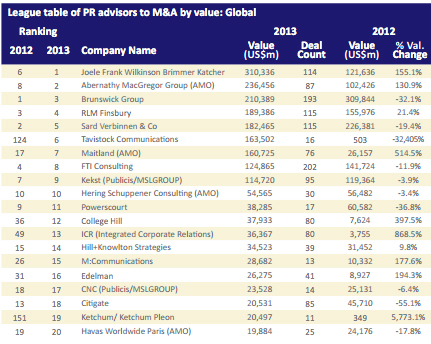

Joele Frank, Wilkinson Brimmer Katcher was the top global M&A PR advisor in 2013 based on deal value.

Joele Frank's $310B across 114 deals trumped No. 2 Abernathy MacGregor ($236B; 87), and the 2012 leader Brunswick Group ($210B; 193), according to mergermarket (view the full report - PDF).

Joele Frank's $310B across 114 deals trumped No. 2 Abernathy MacGregor ($236B; 87), and the 2012 leader Brunswick Group ($210B; 193), according to mergermarket (view the full report - PDF).

FTI Consulting advised the greatest number of transactions in 2013 – 202 – followed by Brunswick, RLM Finsbury (115) and Sard Verbinnen & Co (115).

The top deal of the year was Verizon Communications's $124.1B buyout of Vodafone from its Verizon Wirelesss business in September. Joele Frank, Wilkinson Brimmer Katcher and RLM Finsbury were on the VC end, while Abernathy MacGregor, Maitland and Tavistock Communications aided Vodafone.

That was followed by Berkshire Hathaway's $27.4B acquisition of H.J. Heinz Company -- BH worked with Brunswick Group – and AerCap Holdings' $26.4B buy of International Lease Finance Corp. from AIG. College Hill advised AerCap Holdings. Liberty Global's $25B acquisition of Virgin Media rounded out the top four, as Brunswick advised Liberty and Powerscourt and Tavistock aided Virgin.

Making leaps in the ranking by global deal value, Tavistock landed at No. 6 from No. 126 in 2012, ICR vaulted to 13 from 49, Ketchum rose to 19 from 151, and Edelman jumped to 16 from 31.

Mergermarket reported that global M&A activity slowed in Q4 and was down 3.2% from 2012. But the U.S. saw a 3.8% increase to $891.1B and the 105 lapsed deals in 2013 was the lowest total since 2001.

Spectrum Science acquires clinical trial recruitment and engagement solutions provider Continuum Clinical.

Spectrum Science acquires clinical trial recruitment and engagement solutions provider Continuum Clinical. How PR agency owners can navigate the M&A process in a way that yields a rewarding experience for both owners and the teams they leave behind.

How PR agency owners can navigate the M&A process in a way that yields a rewarding experience for both owners and the teams they leave behind. Ten potential ways an agency sale can positively benefit team members and employees.

Ten potential ways an agency sale can positively benefit team members and employees. Kekst CNC reps Palladium Equity Partners and its joint venture affiliate, Palladium Heritage, on the acquisition of National Auto Parts, USA;, NAP San Diego; and National Auto Parts-Oakland to form Collision Auto Parts, a platform serving customers in the automotive aftermarket collision repair sector.

Kekst CNC reps Palladium Equity Partners and its joint venture affiliate, Palladium Heritage, on the acquisition of National Auto Parts, USA;, NAP San Diego; and National Auto Parts-Oakland to form Collision Auto Parts, a platform serving customers in the automotive aftermarket collision repair sector. ICR has acquired Bullfrog + Baum, the 23-year-old PR shop focused on the hospitality, lifestyle, travel and consumer marketing sectors.

ICR has acquired Bullfrog + Baum, the 23-year-old PR shop focused on the hospitality, lifestyle, travel and consumer marketing sectors.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.