Morgan Stanley and Goldman Sachs gave up millions in fees in order to rank high in deal-making tables, notes consultant Russell Perkins, who says such rankings are “absurdly influential.”

Perkins, who heads Infocommerce Group, Bala Cynwyd, Pa., cited a March 20 Bloomberg story that said Morgan Stanley and Goldman Sachs gave up millions in fees to get credit on a big merger they did not work on so that they would keep their high rankings in M&A ranking tables.

|

The investment banks wanted credit for working on the $25 billion sale of Forest Laboratories to Activis in February even though neither actually had a role in the deal, said the Bloomberg story by David Welch that withheld the names of his sources.

The banks, using previous contracts with Forest, negotiated to get credit for the deal in exchange for millions of dollars in fees that they were owed, said the sources.

“It’s a form of buying league-table credit,” Prof. Erik Gordon of the University of Michigan told Welch.

The Bloomberg story cited the ranking of Dealogic, which is not available on the firm’s website.

Mergermarket.com publishes such a table which shows Goldman Sachs as the No. 1 financial advisor in deals in 2013 -- 304 worth $604 billion. No. 2 is JPMorgan with 656 deals worth $563B.

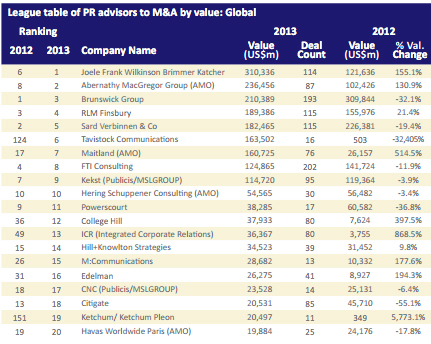

The firm also publishes a table showing the top PR advisors in such deals.

Biz World Hot on Rankings

Perkins, who was previously president/CEO of Dorland Healthcare Information and who has a background of 25 years in database publishing, said rankings have become hugely important in recent years as a quick way to sift through the oceans of information flooding the web.

|

He said that just about every business and industry he knows of has a ranking of one sort or another.

Figures, he said, are mostly self-reported or based on statements of CPAs.

Told about the O’Dwyer PR firm rankings, which are based on tax documents such as top pages of income tax returns and W-3s showing total payroll, he said he knows of no other ranking that collects such documents.

The fact that Goldman Sachs and Morgan Stanley would give up millions in fees to keep their top positions speaks volumes about the importance of rankings, he said.

The banks are “two prestigious, successful and extremely savvy companies that hardly need more publicity and or name recognition,” he noted. He added they are “wiling to trade millions of dollars in fees to push themselves higher in a list that ranks transaction activity…the bragging rights and marketing value of ranking highly will be worth many more millions than those they walked away from.”

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman. New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there.

New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there. Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago.

Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago. While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report.

While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report. Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.