|

|

“The Big Short” movie blames the 2008 financial bust on banks, rating services, Federal Reserve, Wall Street houses and others. Journalism Prof. Dean Starkman keeps insisting that the financial press was a major culprit and that it continues to perform poorly. Journalists dispute this view.

Starkman in 2014 authored The Watchdog That Didn’t Bark, which claims journalists failed to warn about the Wall Street abuses that led to what the Financial Crisis Inquiry Commission said was “the worst market disruption in postwar American history.”

Some $17 trillion in market value disappeared “overnight,” says one of the characters in “The Big Short” which as of Jan. 3 had grossed $33 million (No. 7 among films), according to the Jan. 4 Fandango report.

Millions of homes lost half or more of their value, resulting in mortgages being worth more and even far more than the value of the homes. An economic malaise ensued that lasted for years.

|

|

|

Where Was Starkman & NYFWA?!

The question that arises is why didn’t Starkman himself and other members of the New York Financial Writers’ Assn. sound the alarm long before 2008? Starkman, ex-Wall Street Journal and a former business news editor at the Columbia Journalism Review, was a member of NYFWA in 2011.

Britt Erica Tunick, current executive manager of NYFWA, was president of NYFWA in 2006-07. She was then a senior writer at Absolute Return magazine, focusing on hedge funds. Bradly Finkelstein, with National Mortgage News, was 2004-05 president.

The government, SEC, major news media and others were ignoring individual writers on the dangerous conditions but they might have heeded a warning from the nation’s largest and oldest association of financial writers. A campaign might have busted the walls that concealed a high percentage of financial maneuverings not to mention hanky-panky.

Writers Focused on Annual “Follies”

The obvious answer is that NYFWA, comprised of nearly 200 journalists, is obsessed with its annual “Financial Follies” musical show that pulls about a half million from Wall Street’s biggest institutions rather than focusing on educating and informing the public.

|

|

Its black-tie event each November, in which financial institutions and companies treat upwards of 500 reporters to a banquet and show worth at least $400 for each reporter in terms of ticket prices and drinks, compromises the integrity and independence of the reporters and NYFWA itself.

Dozens of financial writers used to be in the cast each year (including this writer) but the cast has shrunk in recent years. About half of those on stage now are professional actors. Seven of the performers in the 2014 and 2015 were pros although this was not disclosed in the programs.

“The Big Short” is an attempt to place blame for the disaster on various players. In a final summing-up to the audience, it says that “Hundreds of Wall Streeters went to jail” for their misdeeds which involved selling borrowed investments they knew would plummet in value. They pocketed the difference when prices collapsed and they “covered” the sales at bargain prices, it was explained.

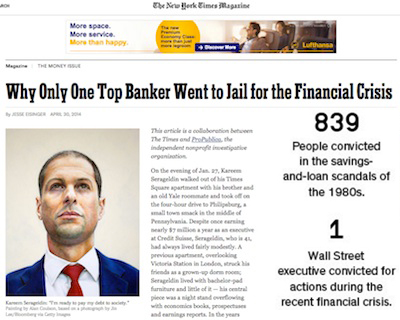

The movie then notes that was a false statement! Only one person went to jail--Kareem Serageldin, an employee of Credit Suisse.

A New York Times profile of Serageldin April 30, 2014 noted that 839 people were convicted of crimes related to the Savings & Loan scandals of the 1980s vs. only one after the 2008 meltdown. NYT highlighted the disparity by showing the numbers one and 839 in type an inch high separated from the rest of the text by white space.

The article says credit for the mass escape from prosecution goes to lawyers who put executives behind a wall called “attorney-client privilege” and who won the right of executives to have their legal bills paid by their employers. The complexity of the issues also made Justice Dept. lawyers doubtful that jurors could be made to understand what had happened, the article says.

“Lack of Transparency” Cited by Commission

The Financial Crisis Inquiry Commission, which heard 700 witnesses in New York, Washington, D.C., and affected cities, and studied millions of pages of documents, concluded that “lack of transparency” was one of the three leading reasons for the meltdown, along with excessive borrowing and risky investments

Reporters, although frustrated by corporate and institutional barriers, did sound the alarm. One of them was Chris Roush, Walter E. Hussman Sr. Distinguished Prof. of Business Journalism, University of North Carolina-Chapel Hill, who wrote “Unheeded Warnings” for the January/December 2009 American Journalism Review.

Reporters, although frustrated by corporate and institutional barriers, did sound the alarm. One of them was Chris Roush, Walter E. Hussman Sr. Distinguished Prof. of Business Journalism, University of North Carolina-Chapel Hill, who wrote “Unheeded Warnings” for the January/December 2009 American Journalism Review.

“The business media in 2008 serve as a welcome scapegoat for those who simply want to ignore their own culpability in the financial meltdown,” says the extensive article. “But it's a bad rap…the business media have done yeoman's work during the past decade to expose wrongdoing in corporate America.

“In fact, a review of the top business publications in the country shows that they blanketed the major issues, from subprime loans to adjustable-rate mortgages to credit derivatives that caused so much economic pain.” Numerous articles were cited by Roush.

Sarah Bartlett, Dean of the CUNY J School, told AJR: "I take umbrage at the notion that financial journalists have let us down.”

Erin Avrelund of Barron’s interviewed 100 sources in 2001 to document that Bernie Madoff’s investment returns were impossible unless a Ponzi scheme was involved. She was mostly ignored. Harry Markopolos also complained to the SEC about Madoff. Johnston Said Warnings Were Squelched

Johnston Said Warnings Were Squelched

David Cay Johnston, investigative reporter, told FCIC that a number of people saw the coming disaster but were “squelched or ignored.” He wrote about overpriced housing twice for NYT in 2004. Similar notes were sounded by Gretchen Morgenson and Floyd Norris of NYT.

Norris, under the headline, “Accountants Misled Us Into Crisis,” wrote Sept. 10, 2009, that “Major banks were hiding dubious assets off their balance sheets.”

Stanley Sporkin, an SEC enforcer from 1961-81, told a Columbia J School symposium Nov. 14, 2000 that financial instruments had become so complex and opaque that they were befuddling journalists. He was convinced there was improper manipulation going on but Ph.D.s and lawyers had put up “a wall of complexity.”

Banks were giving mortgages to almost anyone who showed up, knowing they could quickly off-load the risks to Fannie Mae and Freddie Mac.

Starkman’s claim that “The U.S. business press failed to investigate and hold accountable Wall Street banks and major mortgage lenders in the years leading up to the financial crisis of 2008” doesn’t hold up. Culprits in the mortgage mess, besides the banks, included ratings agencies Fitch, Standard &Poor’s and Moody’s that over-rated investments, and CPAs who allowed off-balance sheet entries.

Starkman Now in Budapest

Starkman was at Yale University Dec. 3, 2015 talking at noon on “Why the Financial Sector Keeps Taking the Public and Press by Surprise” and at 4 p.m. talking on “Journalism’s Crisis—and the Public’s.”

He left Columbia in September 2015, where he had worked since 2007, to join the Los Angeles Times covering Wall Street and financial news from New York. Capital New York picked up the item from the J School’s website.

Yale News reported Dec. 3, 2015 that Starkman moved in December to the School of Public Policy, Central European University, Budapest.

He has become a fellow at its Center for Media, Data and Society, teaching about media and public interest journalism and will take part in a “project to create training and support programs for embattled independent media in Central Europe.” The story notes that Starkman in 2014 published The Watchdog That Didn’t Bark: the Financial Crisis and the Disappearance of Investigative Journalism, which is described as “a wide-ranging critique of the American media’s coverage of Wall Street and mortgage lenders in the years leading up to the financial crisis of 2008.”

Trump Media & Technology Group today reported a $58.2M net loss on $4.1M in 2023 revenues, a disclosure that drove its stock price down 22.6 percent to $47.96.

Trump Media & Technology Group today reported a $58.2M net loss on $4.1M in 2023 revenues, a disclosure that drove its stock price down 22.6 percent to $47.96. Barry Pollack, an attorney at Wall Street’s Harris St. Laurent & Wechsler, has registered Julian Assange as a client with the Justice Dept. “out of an abundance of caution.”

Barry Pollack, an attorney at Wall Street’s Harris St. Laurent & Wechsler, has registered Julian Assange as a client with the Justice Dept. “out of an abundance of caution.” Paramount Global to slash 800 jobs in what chief executive Bob Bakish calls part of an effort to “return the company to earnings growth"... Rolling Stone editor-in-chief Noah Shachtman is exiting at the end of the month due to disagreements with chief executive Gus Wenner over the direction the magazine is taking... The New York Times broke the $1 billion barrier in annual revenue from digital subscriptions in 2023... Press Forward is investing more than $500 million to strengthen local newsrooms.

Paramount Global to slash 800 jobs in what chief executive Bob Bakish calls part of an effort to “return the company to earnings growth"... Rolling Stone editor-in-chief Noah Shachtman is exiting at the end of the month due to disagreements with chief executive Gus Wenner over the direction the magazine is taking... The New York Times broke the $1 billion barrier in annual revenue from digital subscriptions in 2023... Press Forward is investing more than $500 million to strengthen local newsrooms. The majority of news articles are read within the first three days of publication, according to a recent report.

The majority of news articles are read within the first three days of publication, according to a recent report. The Los Angeles Times gives pink slips to 115 people or 20 percent of its newsroom staff... TIME is also laying off about 30 employees, which is approximately 15 percent of its editorial staff... The Baltimore Banner, which was launched by Stewart Bainum in 2022 after he failed to buy the Baltimore Sun, added 500 subscribers per day in the three days following Sinclair Broadcast Group's deal to purchase the Sun.

The Los Angeles Times gives pink slips to 115 people or 20 percent of its newsroom staff... TIME is also laying off about 30 employees, which is approximately 15 percent of its editorial staff... The Baltimore Banner, which was launched by Stewart Bainum in 2022 after he failed to buy the Baltimore Sun, added 500 subscribers per day in the three days following Sinclair Broadcast Group's deal to purchase the Sun.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.