Joe Anthony Joe Anthony |

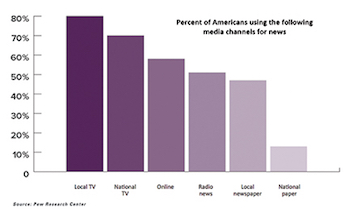

Clearly, the number of ways people receive information has proliferated throughout the last decade, and consumers today are graced with the luxury of picking and choosing their preferred means of getting the news.

|

|

From my years working with financial services professionals, I know many in the business are news junkies. Keeping up with the story of the day, and how it affects their business, is a huge part of the job. While it may surprise some, the nugget of information I bring you today and its implications for the financial services community isn’t about Brexit, the latest top headline. It is representative of a longer-lasting challenge facing the industry as information sharing evolves and is shaped by innovative technologies and new patterns of human behavior.

Here’s what we already know: online sources of information are attracting larger audiences every day. Gone are the days when evening newscasts or local papers broke news stories. Direct mail feels like a quaint relic of the past and emails have multiplied to the point that they are as equally likely to be deleted as they are to be read. However, what you might not realize is that evening news is still relevant to millions of individuals. According to July 2016 study from The Pew Research Center, 57 percent of Americans often get their news from cable, local and network nightly television. People also like reading mail — from their mailbox or inbox — and 20 percent of Americans still regularly peruse print newspapers.

|

Now, some in the finance industry think the biggest “F” word to impact their business is the fiduciary rule announced by the Department of Labor earlier this year. But I contend another “F” word will make engaging current clients and attracting new ones more difficult than ever: fragmentation.

There is no longer a “silver bullet” line of communication that guarantees companies will reach their target audience in one fell swoop. Fragmentation is here and seems to occupy the space between relevance and obsolescence for a wide variety of news and information sources.

Fortunately, the marketing communication paradigm has evolved to help meet this new challenge. Given the natural time and resource constraints facing executives, the idea of having to proactively communicate and engage in multiple arenas can feel daunting. But worry not — integrated public relations campaigns can make a difference in this era of information fragmentation. Here’s how:

Commit to custom content

Buying canned content is relatively cheap. Curating content shows you are paying attention, but custom content trumps the canned and curated on three fronts. It establishes your firm’s voice and specific perspective, it can power your search engine optimization and publicity efforts and it makes the material more shareable in a world revolving around the power of social media.

Leverage content across channels

Is your content good enough for your company blog? If so, it’s probably worth repackaging on LinkedIn Pulse. Did you happen to receive positive feedback from a recent presentation topic? Chances are those same sound bites will resonate with the press. The time and effort you put into generating custom content is too valuable not to mobilize in multiple fashions. But don’t just repost on various platforms. Take the time to cater your material to the specific demographics associated with each communication silo.

Measure feedback or response

It is stunning how many financial services companies fail to monitor their web traffic. Most advisers on social media tend to vastly under or overestimate the size of their social networks simply because they aren’t paying attention. Ask yourself, what blog post was viewed the most? What LinkedIn comment yielded the most shares, likes or comments? Use Google Analytics and other traffic monitoring software to track which blog posts are bringing visitors to your company’s website.

Expand your audience with coverage

Our friends in the media are regularly seeking experienced professionals to provide perspective on topics of interest. Chiming in when opportunity knocks can mean putting your firm’s name in front of new audiences. Media coverage also offers firms the opportunity to leverage the outlet’s distribution to reach new people and prospective clients. Media outlets are becoming increasingly savvy at disseminating information across multiple social channels. If your intended audience on television did not catch the original live broadcast, they might find it on Twitter the next day.

It’s no secret that web-based platforms are growing as a primary source of information, especially for younger people. But according to the Pew Research study, just 38 percent of Americans use the internet often to get their news. While it’s prudent to target this channel, it’s also important to remember it represents just one slice of an increasingly fragmented media landscape.

In order to maximize the scope of your marketing and public relations efforts, each channel used to distribute information must be captured and utilized to its full potential. As your targeted audience disperses to difference corners or the media spectrum, it’s now your job to take the conversation to clients and prospects where they live.

Adapting your communications and marketing efforts to meet the increasingly fragmented audience is no longer a choice, but an imperative. Failure to adapt could crush your future marketing efforts and leave you in the dust behind your peers. While all of this can feel like an intimidating task, fear not — public relations representation is here to navigate this constantly evolving landscape.

* * *

Joe Anthony is President of Financial Services at Gregory FCA.

Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management.

Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management. Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield.

Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield. Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office.

Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office. Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range.

Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range. Kekst CNC represents Grant Thornton as it sells a majority stake in its US arm to New Mountain Capital, which relies on Goldin Solutions, in what is billed as the largest PE investment in the accounting and advisory sector.

Kekst CNC represents Grant Thornton as it sells a majority stake in its US arm to New Mountain Capital, which relies on Goldin Solutions, in what is billed as the largest PE investment in the accounting and advisory sector.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.