Asset management firms appear to recognize the role thought leadership plays in their PR programs, with nearly nine out of every 10 — or 88 percent — of the world’s largest money managers now utilizing content marketing as part of their communications toolkit, according to a report by fintech PR specialists BackBay Communications that sought to analyze the content creation and sharing habits of the world’s 200 largest asset management firms.

The study also found that more than half (51 percent) of the world’s largest money managers now publish new content on at least a weekly basis, with an even higher percentage of asset managers based in the U.S. doing so (62 percent).

Social media is clearly the preferred channel for distributing this content, as 95 percent of global money managers are now active on at least one social platform. Nearly three-quarters (74 percent) now utilize four or more social media channels, and three out of every five (59 percent) typically manage a minimum of five social media channels.

|

LinkedIn remains the preferred social hub for asset managers, with 95 percent of the top 200 firms actively using the jobs networking platform. Twitter isn’t far behind, at 82 percent, while YouTube represents the third-most popular social platform, at 78 percent. Facebook and Google+ see adoption activity of 71 percent and 65 percent, respectively.

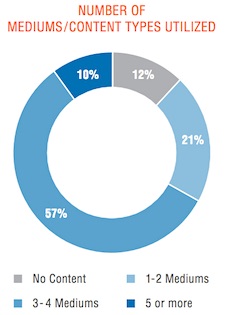

Perhaps the biggest takeaway: the study found that a substantial majority of the world’s largest asset managers now utilize multiple channels in their integrated PR strategy, with 67 percent regularly publishing at least three different types of content across multiple mediums, including everything from corporate magazines, to infographics, to published roundtables or branded radio broadcasts.

The study found that video remains the most common medium used, at 93 percent, followed by insights or market commentaries, at 90 percent. Webinars or podcasts are also employed by a slight majority (55 percent).

Finally, the study also found that the largest firms typically produce nearly double the amount of content — and distribute it with far greater frequency across more channels — than the smallest firms in the list.

BackBay’s whitepaper analyzed publicly available data on the largest asset managers firms’ websites and social media channels to quantify how many produce content regularly, the types of content created across various channels and the frequency at which firms are publishing new content. Firms were chosen based on Pensions & Investments’ Global Money Managers ranking, which lists the largest firms by total assets under management.

Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management.

Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management. Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield.

Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield. Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office.

Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office. Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range.

Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range. Kekst CNC represents Grant Thornton as it sells a majority stake in its US arm to New Mountain Capital, which relies on Goldin Solutions, in what is billed as the largest PE investment in the accounting and advisory sector.

Kekst CNC represents Grant Thornton as it sells a majority stake in its US arm to New Mountain Capital, which relies on Goldin Solutions, in what is billed as the largest PE investment in the accounting and advisory sector.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.