PR firms accounting for between $10 and $25 million in net revenues reported higher profitability than agencies of larger or smaller size, according to an annual survey conducted by merger and acquisition consultancy Gould+Partners.

Gould+Partners’ 2018 Best Practices Benchmarking Report, which analyzes key factors affecting PR firm profitability, found that average profitability of U.S. PR agencies in 2017 was 18 percent of their net revenues, up from the 15.2 percent reported in Gould+Partners’ survey last year but still below the minimum 20 percent profitability that Gould+Partners managing partner Rick Gould recommended as a goal for firms aiming to maintain maximum value while investing in infrastructure, quality staff and digital capabilities.

|

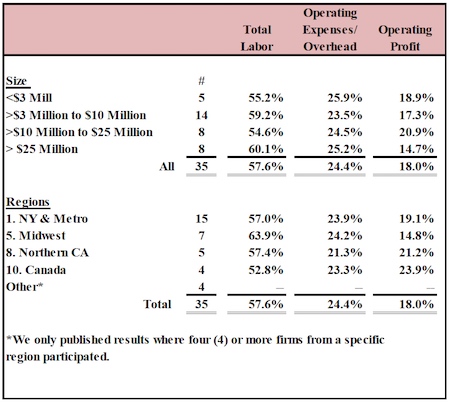

The survey’s findings suggested that organic growth last year remained particularly flat at larger firms: PR agencies in excess of $25 million in revenue netted only 14.7 percent profitability, while firms boasting between $10 million and $25 million netted a healthy 20.9 percent profitability. By contrast, firms accounting for between $3 million and $10 million netted 17.3 percent profitability, and firms with under $3 million in revenue netted 18.9 percent.

Gould told O’Dwyer’s that this “growth gridlock” that appears salient for firms in the under-$10 million and over-$25 million categories was what surprised him most in this year’s findings, suggesting that a “sweet spot” for maximum profitability appeared to exist most often among firms bringing in between $10 and $25 million in net revenues.

Gould said this group also exhibited the highest net revenue per staff for PR professionals (admins excluded), lower operating expenses and the lowest percent of total labor against net revenues, all benchmarks that portend strong profitability.

Agencies in this middle range also had the highest average monthly retainers.

The Gould+Partners survey also found that total overhead at U.S. PR agencies averaged 24.4 percent this year, a 1.5 percent decline from last year’s 25.9 percent.

On the other hand, revenue per professional staff was $239,917, up from $211,995 two years ago.

Staff turnover is also on the rise, averaging about 25 percent for the year, compared to about 22 percent last year. For small firms, the turnover rate is actually much higher, averaging 29.7 percent, an increase from last year’s 27.7 percent.

Finally, the survey found that firms located the northern California region exhibited the highest operating profit in the U.S. (21.2 percent), followed by firms in the New York and its surrounding metro area (19 percent) and the Midwest (14.8 percent). Like last year and the four years before it, Canadian firms participating in the survey averaged the highest operating profit of all, 23.9 percent.

Gould+Partners’ latest Benchmarking survey was based on responses from 35 “prominent, best of class” North American PR agencies. It was conducted in April and May.

Spectrum Science acquires clinical trial recruitment and engagement solutions provider Continuum Clinical.

Spectrum Science acquires clinical trial recruitment and engagement solutions provider Continuum Clinical. How PR agency owners can navigate the M&A process in a way that yields a rewarding experience for both owners and the teams they leave behind.

How PR agency owners can navigate the M&A process in a way that yields a rewarding experience for both owners and the teams they leave behind. Ten potential ways an agency sale can positively benefit team members and employees.

Ten potential ways an agency sale can positively benefit team members and employees. Kekst CNC reps Palladium Equity Partners and its joint venture affiliate, Palladium Heritage, on the acquisition of National Auto Parts, USA;, NAP San Diego; and National Auto Parts-Oakland to form Collision Auto Parts, a platform serving customers in the automotive aftermarket collision repair sector.

Kekst CNC reps Palladium Equity Partners and its joint venture affiliate, Palladium Heritage, on the acquisition of National Auto Parts, USA;, NAP San Diego; and National Auto Parts-Oakland to form Collision Auto Parts, a platform serving customers in the automotive aftermarket collision repair sector. ICR has acquired Bullfrog + Baum, the 23-year-old PR shop focused on the hospitality, lifestyle, travel and consumer marketing sectors.

ICR has acquired Bullfrog + Baum, the 23-year-old PR shop focused on the hospitality, lifestyle, travel and consumer marketing sectors.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.