PR firms, on average, increased their hourly billing rates last year from 2016, according to results from an annual survey conducted by PR merger and acquisition consultancy Gould+Partners.

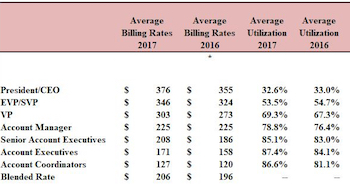

Average billing rates for all account staff in 2017 — from the president/CEO all the way down to the account coordinators — was $206 per hour, compared to $196 in 2016.

|

|

Rates for virtually every account function have gone up, but especially so among senior staff: CEOs and presidents charged $376 per hour last year, versus $355 in 2016; EVPs/SVPs charged $346 per hour, compared to $324; and VPs charged $303 compared to $273. The only outlier in this regard were account managers, who maintained a flat average rate of $225 per hour.

Senior staff are billing more, but when it comes to account staff productivity — which is measured by billable time utilization — that number creeped down in the past year for account teams’ most senior staff members.

Presidents/CEOs billed out an average of only 32.6 percent of their theoretical yearly capacity of 1,700 hours (compared to 2016’s 33 percent), and EVPs/SVPs billed out 53.5 percent (down from 2016’s 54.7 percent), according to the survey.

However, Gould+Partners managing partner Rick Gould told O’Dwyer’s that the productivity of CEOs and EVPs can’t be seen as accurate benchmarks, given that much of their time is spent on new business and management.

On the other hand, productivity was actually up for staff on the bottom end of the hierarchy pyramid. VPs billed out 69.3 percent of their hours in 2017, compared to 67.3 percent in 2016. Account managers logged 78.8 percent, versus 2016’s 76.4 percent. Account coordinators revealed productivity of 86.6 percent, compared to 2016’s 81.1 percent. And account executives exhibited the highest productivity of all, billing out 87.4 percent last year, according to the survey.

"The real news," according to Gould said, “is that utilization/billability is going up at the staff levels.”

“What I look at is trends with VPs, account managers, account execs and account coordinators. These are the staff levels that produce the majority of the billable work,” Gould said. “Higher level executives should be doing more ‘strategic, big picture billable work’ and maintaining client relationships. The goal for all firms should be that the CEO/President not spend more than a third of their time on billable work.”

Still, Gould told O’Dwyer’s that 90 percent should be the minimum expected productivity rate for account staff not involved in management and new business.

Gould+Partners’ “Billing Rates/Utilization Report” was based on responses from 35 selected “best of class” PR agencies based in the U.S. and Canada.

Copies of the survey are available on request by contacting Rick Gould, [email protected], or 212/896-1909.

Average rates and utilization, 2017 versus 2016.

Average rates and utilization, 2017 versus 2016.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman. New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there.

New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there. Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago.

Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago. While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report.

While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report. Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.