Google dominates the U.S. search ad market, but the search giant’s current share of search ad revenues is expected to dip within the coming years while Amazon’s will rise, according to the latest ad spending forecast by digital market research company eMarketer.

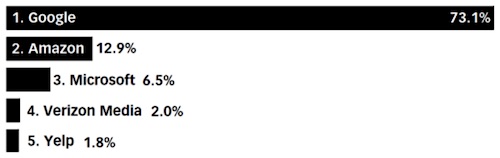

Overall, the U.S. search ad market will grow nearly 18 percent this year to total more than $55 billion, according to eMarketer’s report, which includes search ad spending on desktop and laptop computers, as well as mobile phones, table and other Internet-connected devices. Google is expected to account for 73.1 percent of that total, or about $40.33 billion.

Top five companies in the U.S., ranked by search ad revenue share (percent of total). Top five companies in the U.S., ranked by search ad revenue share (percent of total). |

Google’s share of the U.S. digital ad market is slipping, however. The search giant is expected to take 37.2 percent of all U.S. digital ad spends this year (or about $48.05 billion) representing a dip from 2018’s 38.2 percent. Google’s overwhelming share of the paid-search market is also expected to drop, slipping to an estimated 70.5 percent by 2021.

Amazon, meanwhile, will see its search ad revenues grow nearly 30 percent this year from 2018, accounting for nearly 13 percent of the U.S. search ad market (or about $7.09 billion).

eMarketer predicts Amazon search revenue share will continue to climb, gaining an additional 30 percent in 2020 (to $9.27 billion) and 26 percent in 2021 (to $11.70 billion).

The Internet’s largest retailer, which is currently the number-two search ad platform, surpassed Microsoft last year, which now ranks number-three for search, with about 6.5 percent of the market. Verizon Media ranks number-four with two percent. Yelp rounds out the top five at 1.8 percent.

Amazon in July was ranked the top digital media platform in terms of perceived ROI among advertisers, according to data from equities researcher Pivotal Research Group.

Adam Shapiro, who helped develop FGS Global’s digital strategy, has joined Reevemark as its digital head.

Adam Shapiro, who helped develop FGS Global’s digital strategy, has joined Reevemark as its digital head. Avika Dua, who was digital director for New York governor Kathy Hochul, has joined SKDK as a VP to work on both political and corporate campaigns.

Avika Dua, who was digital director for New York governor Kathy Hochul, has joined SKDK as a VP to work on both political and corporate campaigns. Maxwell Nunes, who was director of paid media for South Bend mayor Pete Buttigieg’s bid for the Democratic presidential nomination, has joined SKDK as executive VP.

Maxwell Nunes, who was director of paid media for South Bend mayor Pete Buttigieg’s bid for the Democratic presidential nomination, has joined SKDK as executive VP. Erin Gentry, one-time US president of Hill+Knowlton Strategies, has joined digital marketing shop Acronym as COO.

Erin Gentry, one-time US president of Hill+Knowlton Strategies, has joined digital marketing shop Acronym as COO. TikTok CEO Shou Zi Chew has agreed to appear before the House Energy and Commerce Committee on March 23 to testify on the company’s consumer privacy and data security practices, as well as its ties with China's government.

TikTok CEO Shou Zi Chew has agreed to appear before the House Energy and Commerce Committee on March 23 to testify on the company’s consumer privacy and data security practices, as well as its ties with China's government.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.