Staff and client turnover remain ongoing challenges for the professional services sector, but a new report by merger and acquisition consultancy Gould+Partners suggests that turnover has risen sharply in the public relations industry in particular, with agencies experiencing high levels of both staff and client turnover in 2019.

Average staff turnover rate for firms participating in the survey was 22.9 percent, making turnover within the PR industry more than twice as high as the average turnover in the professional services sector at large, according to the report.

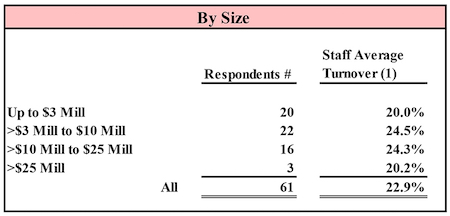

Average staff turnover rate at U.S. PR agencies in 2019. Average staff turnover rate at U.S. PR agencies in 2019. |

Staff turnover rose among firms across all revenue levels in 2019, but the smallest firms—those with less than $3 million in revenues—appeared to exhibit the lowest rates of staff turnover, at 20 percent. The largest firms—those with revenues of more than $25 million—also lost relatively few employees, at 20.2 percent. PR firms with revenue between $3 million and $10 million were hit hardest, with turnover of 24.5 percent last year. And firm with revenue between $10 million and $25 million were close behind, with turnover of 24.3 percent.

Staff turnover was high across the country but was particularly elevated at agencies in the Southwest (38.4 percent), followed by Southern California (31.6 percent), the Southeast (22.8 percent) and the New York City metro area (22.7 percent). Staff turnover remained relatively low in the Midwest (16.9 percent) and Northern California (18.3 percent). The only region that didn’t see double-digit staff turnover rates in 2019 was the Northwest, where staff retention was actually up two percent.

When it comes to client retention, average turnover rate for agencies in 2019 was 23.4 percent. Agencies across revenue levels experienced client losses, but once again, the smallest firms—those with less than $3 million in revenues—saw the smallest amount of client churn in 2019 (17.7 percent). Firms with revenues between $10 million and $25 million suffered the worst client losses, at 28 percent. The largest firms—those with revenues of more than $25 million—saw client turnover of 23.6 percent. Agencies with revenues between $3 million and $10 million experienced a similar number, 23.1 percent.

Agencies located in the Southwest saw the greatest client losses (34.6 percent), followed by Southern California (31.8 percent), Northern California (26.8 percent) and the Southeast (25 percent). Once again, the Northwest proved a lone exception, where client retention was up two percent.

Gould+Partners managing partner Rick Gould told O’Dwyer’s that these numbers present serious financial implications for PR firm owners. The top strategic priority of every firm should be to build value, Gould said, and turnover should always remain a top-of-mind concern because nothing builds agency value like people and clients.

“When a firm considers selling, the number-one item a prospective buyer looks at is the people… the people that get the work done and keep the clients happy,” Gould said. “The second most important item is the clients. They look at the fee pattern for the past three years, how long you have retained each client, which clients were lost and why you lost the client. A buyer wants to see a stable book of business, one that they can grow in both fees and profitability. With key staff turnover, there will be key client turnover. Retaining key staff will be key in having low client turnover and continuously building value to the firm.”

Gould also told O’Dwyer’s he believes panic surrounding the ongoing coronavirus (COVID-19) outbreak could only lead to increased client and staff turnover in the industry.

Gould+Partners’ “PR Industry Turnover Report” was based on responses from 61 PR agency owners.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman. New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there.

New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there. Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago.

Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago. While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report.

While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report. Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.