U.S. PR agencies managed to remain profitable in 2020 despite the severe economic damage wrought by the COVID-19 pandemic, according to an annual industry survey conducted by PR merger and acquisition consultancy Gould+Partners.

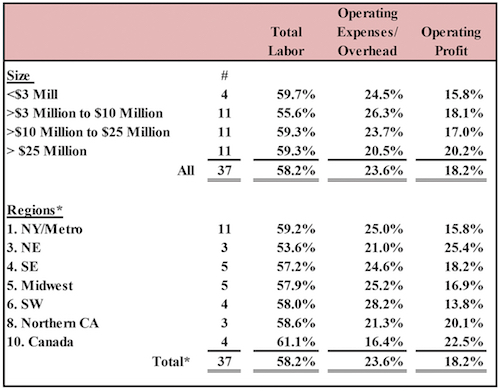

Gould+Partners’ latest Benchmarking report, which analyzes key factors affecting PR firm profitability, found that PR agencies in 2020 saw, on average, profitability reach 18.2 percent of firms’ net revenues (calculated as fee billings + markups), up from 17.4 percent in pre-pandemic 2019.

|

The survey’s findings discovered that profitability last year was particularly high at the largest firms: PR agencies with revenues in excess of $25 million netted average operating profits of 20.2 percent in 2020. Firms accounting for between $3 million and $10 million in revenues netted profitability of 18.1 percent, while firms with between $10 million and $25 million in revenues netted 17 percent. The smallest firms—those with under $3 million in revenues—netted the smallest profitability, 15.8 percent.

Gould+Partners managing partner Rick Gould told O’Dwyer’s that “there were three main reasons” that the PR sector was able to weather the impacts of the COVID-19 pandemic.

First, Gould cited economic recovery grants and loans such as the Small Business Administration’s Paycheck Protection Program, which offered billions in small business relief and provided a lifeline to retain staff that would have been laid off or furloughed. Second, many agencies in 2020 were able to get rent abated or deferred. Finally, Gould said that many firms—driven either by careful planning or a mere state of panic—made a series of line-by-line cuts in their overhead, to everything from travel and expenses to freezing salaries, pay cuts and bonuses. Indeed, the Gould+Partners report found that total overhead in 2020 averaged 23.6 percent, down from 24.8 percent in 2019.

“All of these moves went directly to the bottom line,” Gould said. “By watching the numbers monthly, by managing by best practices benchmarks, [agency owners] were able to squeeze out additional profitability and move into 2021 much leaner and positioned for an even better 2021. It truly showed the resilience of the well-managed PR agencies.”

When broken out by region, the report found that PR firms located in the U.S. Northeast boasted the highest average operating profits in 2020 (25.4 percent), followed by firms in Canada (22.5 percent), northern California (20.1 percent) and the U.S. Southeast (18.2 percent). Among the least profitable were firms located in the Midwest (16.9 percent), firms located in the New York City metro area (15.8 percent) and firms in the Southwest (13.8 percent).

The study also found that revenue per professional staff member averaged $256,667 in 2020, up from $244,840 in 2019; and staff turnover for the year averaged 18 percent, compared to 2019’s 16.7 percent.

Gould+Partners’ latest Benchmarking Survey was based on responses from 37 “prominent, best of class” North American PR agencies. Responses were collected in May.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman. New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there.

New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there. Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago.

Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago. While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report.

While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report. Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.