|

Companies that are perceived as being more trustworthy are seeing the results of that in their financial performance, according to a new report from Boston Consulting Group.

BCG examined 1,100 of the world’s largest companies, using artificial intelligence and natural language processing, and found that the 100 who racked up the top scores for trust generated 2.5 times as much value as did the market as a whole.

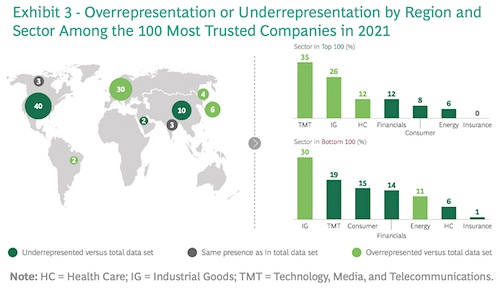

While the US had the most companies (40) in the top 100, it was still punching slightly below its weight, as it represented 45 percent of the full data set. On the other hand, European companies were overperformers, accounting for 30 out of the top 100, from just 23 percent of the full set.

Out of the rest of the top 100, 10 companies were from China, six from Japan and four from South Korea, with the remainder coming from India, the Middle East, Canada and Brazil.

When it comes to market sector, companies in technology, media and telecommunications did the best, representing 35 of the top 100. Other top performers included industrial goods (26), healthcare and financials (12 each) and consumer (8).

|

The study found that holding onto a spot in the top 100 is a daunting task. Out of the 100 firms that were on the top 100 list in 2018, only 20 of them were still on the list in 2021.

COVID, as might be expected, had an impact on trust. However, that impact was not uniform across the board. While for the market as a whole, trust levels rose two percent annually from 2018 to 2021, the top 100 saw a more modest bump, up one percent per year—a difference the study’s authors attribute to the already high trust levels of the top companies.

The bottom 100 companies, on the other hand, saw a relatively steep decline, down by 10 percent a year.

The factors behind a company’s trust level are also discussed in the report. Those are competence (whether or not a company can deliver on its promises to stakeholders), fairness, transparency and resilience.

While for the top 100 companies, those four factors are relatively equal in strength (ranging from 24 percent for competence to 27 percent for resilience), the competence score declines the farther down the list you go, hitting 17 percent for the market as a whole and just 10 percent for the bottom 100 companies, showing the power of paying attention to a business’s basics.

The study also zeros in on what it calls “trust destroyers” (including corruption, fraud, scandals and catastrophic events), “trust foundations” (financial position, governance and workforce, and product and service performance) and “trust enhancers” (strategic collaboration and investment, innovation, and social responsibility).

The study’s authors emphasize that the bottom-line importance of trust will likely increase. “As online interactions increasingly supplant face-to-face interactions, trust is becoming ever more essential for virtually every enterprise.”

To analyze the firms in its report, BCG looked at references companies gleaned from more than 100,000 sources worldwide, incorporating both traditional media (such as wire services and newspapers) and social media.

Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem

Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX.

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX. AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack.

AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack. A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes. Thought leadership can make made B2B brands more "powerful and attractive to buyers," according to Edelman report.

Thought leadership can make made B2B brands more "powerful and attractive to buyers," according to Edelman report.

Have a comment? Send it to

Have a comment? Send it to

May 24, 2022, by Joe Honick

This fuzzy and fragile idea of trustworthiness is probably as well handled by BCG as anyone could have tackled. It makes clear the "flipflop" nature of such data from one year to another. What is not really clear are two aspects at least: methods used, as noted here, were AI and something called "natural language processing", both lacking clear understanding of the human element.

Most consumers of "stuff" hardly have the time or inclination to think of trustworthiness unless they get products that work and follow up service or difficulty with both.

BCG is a powerful and reliable organization that owed both conclusions and language in such a study and less of the veneer of elitism, however scholarly.