In another sign of recovery for the post-COVID economy, the U.S. PR industry saw impressive growth in 2021, according to an annual industry survey conducted by PR merger and acquisition consultancy Gould+Partners.

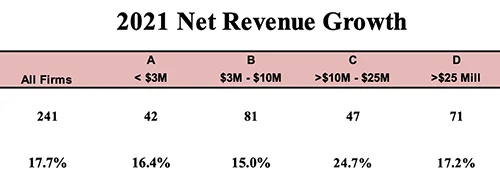

The Gould+Partners’ report, which focused on net revenue growth—calculated as fees plus mark-ups—found that North American PR agencies saw average net-revenues gains of 17.7 percent in 2021, a complete turnaround when compared to the meager 3.1 percent growth the sector yielded in COVID 2020, which was the lowest growth year since Gould+Partners began tracking this data a decade ago.

|

Firms of all sizes surveyed in the study—from the largest PR shops to the smallest—reported increased net revenues, according to the survey. Firms bringing in between $10–$25 million in annual net revenues were the most profitable last year, growing an incredible average of 24.7 percent. The largest PR shops—or agencies boasting more than $25 million annually—also saw big gains in 2021, at 17.2 percent. The smallest firms polled—those with under $3 million in net revenues—grew at an average of 16.4 percent. Firms with net revenues between $3–$10 million saw growth of 15 percent.

“What this report validates is that, contrary to what may be happening on a national level, that we are in a ‘recession,’ the PR industry is not in a recession and, if anything, is on a growth trajectory,” Gould+Partners Managing Partner Rick Gould told O’Dwyer’s. “Every indication I have had, based on our three major surveys, and discussions with PR firm executives, is that 2022 will be another year of growth and profitability.”

The Gould+Partners report also found that among ten regions ranked, PR firms stationed in Northern California grew the most in 2021 (27 percent), followed by firms located in the U.S Southwest (24 percent), Southern California (22 percent), the Washington, D.C. area (20 percent), the New York metro area (17 percent), the U.S Northeast (16.8 percent), the Midwest (15.4 percent), the Northwest (13 percent), the Southeast (12 percent) and Canada (8 percent).

Gould+Partners’ 2022 “Net Revenue Growth Report” was based on responses from 241 PR agencies located across North America.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman. New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there.

New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there. Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago.

Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago. While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report.

While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report. Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.