|

While healthcare companies are increasingly attractive investment targets, those companies are coming up short in their communications targeted at investors, according to a recently released report from Edelman.

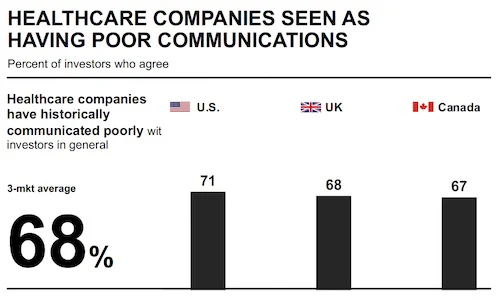

The Edelman Trust Barometer’s special report on healthcare institutional investors, which surveyed investors in the U.S., UK and Canada, found that almost seven in 10 respondents (68 percent) said “healthcare companies have historically communicated poorly with investors in general.”

Responses were consistent across all three countries, with the U.S. (71 percent) only slightly more negative than the UK (68 percent) and Canada (67 percent).

And major improvements do not seem to be on the horizon. About two-thirds (64 percent) of U.S. respondents said that healthcare companies are not prepared to provide effective communication to investors. Though that number was even higher (68 percent) in Canada, the UK was a bit more positive, with only 52 percent noting a lack of communications preparation on the part of healthcare companies.

|

This could prove to be a big problem for healthcare companies, since there is widespread agreement that information is a pivotal factor in the decision to invest in a company. Overall, 78 percent of survey respondents said their firm would not invest in a company that did not provide sufficient operational and/or performance information.

Investors also said that they cast their nets fairly wide when researching a company, using five to six sources on average to assess potential healthcare investments. Company websites (48 percent) were the most frequently noted source, followed by the company’s investment portfolio (44 percent) and ESG report (37 percent).

This comes as the healthcare industry’s reputation in the investment community is experiencing an upswing. Nearly nine out of ten respondents (87 percent) said that the pandemic had emphasized the value of healthcare investments in the long term.

In response, more than three-quarters of respondents (78 percent) said they increased their allocation in healthcare in 2021. In addition, a majority (57 percent) think that the sector will continue to grow post-pandemic.

And while innovation and digital transformation emerged as key factors in the industry’s favor, the report also underlines that ESG considerations play a big role in how attractive a company is to investors. 73 percent of respondents said they would not invest in companies without sufficient ESG mandates, and 81 percent noted that a healthcare company with strong ESG performance deserves a premium valuation to its share price.

Edelman’s report surveyed 225 healthcare institutional investors, including chief investment officers, financial analysts, portfolio managers and directors of research.

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX.

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX. AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack.

AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack. A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes. Thought leadership can make made B2B brands more "powerful and attractive to buyers," according to Edelman report.

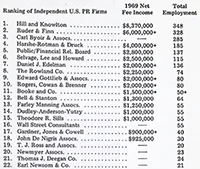

Thought leadership can make made B2B brands more "powerful and attractive to buyers," according to Edelman report. The deadline for O'Dwyer's 2024 rankings of PR firms, a benchmark study of the growth of the industry annually since 1970, is Mon., Mar. 11, 2024.

The deadline for O'Dwyer's 2024 rankings of PR firms, a benchmark study of the growth of the industry annually since 1970, is Mon., Mar. 11, 2024.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.