|

Tech companies are shifting their communications increasingly toward customer engagement and loyalty, according to a new study from Alloy.

The Alloy Technology Marketing Report surveyed more than 115 B2B tech professionals in sales and marketing positions in July and August of this year and found that addressing the full customer lifecycle was a top priority.

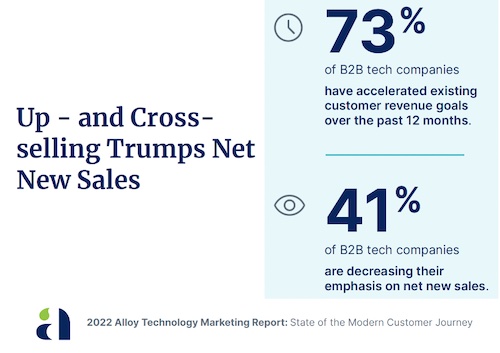

Close to three-quarters (73 percent) of the survey respondents said that they have accelerated their revenue goals from existing customers over the past 12 months, and that number rises to 86 percent for FinTechs and 94 percent for HealthIT companies.

On the other side, more than four in 10 (41 percent) said that they were reducing their emphasis on net new sales.

This change may be at least partly due to changes in buyer behavior. One of those changes: B2B buyers are more willing to make large purchases online than they were in the past. In addition, the overall digital transformation of the market has made it necessary for tech brands to reposition themselves and enter new markets in order to stay competitive.

|

Those shifting boundaries have reshaped the customer experience for many buyers in the tech sector, raising the importance of maintaining existing relationships and bolstering customer retention.

When it comes to what department is ultimately responsible for growing customer revenue, sales still comes out on top, cited by nearly half (49 percent) of respondents. But the power of customer success (21 percent) and customer experience (10 percent) is considerable, together accounting for almost a third of responses.

Ultimately, survey respondents agreed that the real key to revenue growth is collaboration. Nearly 70 percent said that their organization would be more successful if sales, RevOps, marketing, CX and customer success were more closely aligned. For vendors selling IT solutions, that number rises to 95 percent.

“This data signals that global tech brands in today’s market conditions are shifting their focus to a customer’s lifetime value—not the initial sale and average customer value,” the study’s authors say.

Laura Anderson, who rose to VP/GM of global communications and events in a nearly 20 year stint at Intel, will take on the Americas technology chair at Burson following the completion of the BCW and H+K merger on July 1.

Laura Anderson, who rose to VP/GM of global communications and events in a nearly 20 year stint at Intel, will take on the Americas technology chair at Burson following the completion of the BCW and H+K merger on July 1. WE Communications has partnered with ROKK Solutions to form the WE ROKK AI service.

WE Communications has partnered with ROKK Solutions to form the WE ROKK AI service. In the dynamic world of modern business, effective communication is a pivotal tool for success across various industries. At Communications Strategy Group (CSG®), our expertise in embracing innovation in communication extends beyond traditional marketing strategies, paving the way for transformative industry-specific solutions.

In the dynamic world of modern business, effective communication is a pivotal tool for success across various industries. At Communications Strategy Group (CSG®), our expertise in embracing innovation in communication extends beyond traditional marketing strategies, paving the way for transformative industry-specific solutions. There are two types of tech PR professionals. Which one are you? And are C-suite executives making that decision for you?

There are two types of tech PR professionals. Which one are you? And are C-suite executives making that decision for you? While there’s an impulse to grab reporters’ attention with the newest industry-transforming tech product or service, a back-to-basics approach focused on telling the right stories to the right people is a far more successful way to ensure your technology campaign breaks through the clutter of today’s crowded tech landscape.

While there’s an impulse to grab reporters’ attention with the newest industry-transforming tech product or service, a back-to-basics approach focused on telling the right stories to the right people is a far more successful way to ensure your technology campaign breaks through the clutter of today’s crowded tech landscape.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.