|

A focus on the positive is key to successful communications about retirement issues, according to a new study from investment managers Capital Group and market research firm Escalent.

“The Art of Retirement Communications” found that negative language, such as warnings of potential mistakes or phrases like “time is running out,” was the least likely to connect with consumers. For example, only about a quarter (24 percent) of respondents said the phrase “unexpected expenses can derail you” resonated with them.

Messages that center around successful planning or on a comfortable retirement were considerably more appealing. One message focused on planning (“Plan the retirement you deserve”) was deemed appealing by 44 percent of respondents—with 42 percent saying that such a message would encourage them to take action.

Envisioning a secure retirement ranked even higher. Almost half (48 percent) were drawn in by “save enough today to enjoy a comfortable future,” with 45 percent noting that such a statement would encourage them to take action.

|

Sticking to the facts was also a plus, with factual statements resonating across all demographics considerably more than product-related messages.

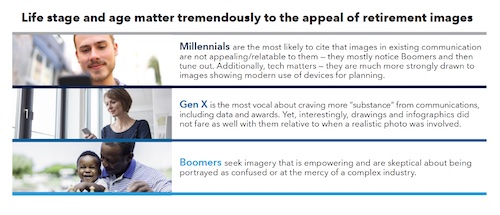

Each generation has different expectations of what they want from retirement communications, the study says. An emphasis on planning means more to Millennial and Gen X than it does to Boomers, who prefer messaging that centers on enjoying retirement and the immediate steps they need to take to get there.

Millennials also said that they found the imagery used in retirement-related communications to be generally unappealing (“they mostly notice Boomers and then tune out”). They also wanted to see “images showing modern use of devices for planning.”

Boomers, on the other hand, expressed a desire to see images that they find empowering. They also resent “being portrayed as confused or at the mercy of a complex industry.”

The study also found a risk of relying too heavily on images. Noting that “the significance that individuals ascribe to an image is deeply personal,” the study authors note that an image that may hit the mark with some audience segments may be totally off base for others.

Surprisingly, images representing inclusivity did not register particularly well with respondents. While respondents said they want to see diversity in communications, such images were less cited as less likely to encourage them to want to prepare for the future, want to save more or want to create a plan. Language stressing inclusivity also missed the mark, with phrases like “strategies for every life and stage” only connecting with four out of 10 respondents.

Jargon-filled language was cited as another barrier to successful retirement communications. “Understandable language is often more reliable than imagery to relay a message,” the study notes.

But the most important feature of successful retirement communication is to keep a focus on both outcomes and planning. “To prepare for retirement, people need to be able to envision the end result.”

The Capital Group/Escalent study polled 2,451 from a mix of ages, genders, races and ethnicities in Q4 2021.

Abandon traditional content plans focused on a linear buyer progression and instead embrace a consumer journey where no matter which direction they travel, they get what they need, stressed marketing pro Ashley Faus during O'Dwyer's webinar Apr. 2.

Abandon traditional content plans focused on a linear buyer progression and instead embrace a consumer journey where no matter which direction they travel, they get what they need, stressed marketing pro Ashley Faus during O'Dwyer's webinar Apr. 2. Freelance marketers and the companies that hire them are both satisfied with the current work arrangements they have and anticipate the volume of freelance opportunities to increase in the future, according to new data on the growing freelance marketing economy.

Freelance marketers and the companies that hire them are both satisfied with the current work arrangements they have and anticipate the volume of freelance opportunities to increase in the future, according to new data on the growing freelance marketing economy. Home Depot's new attempt to occupy two market positions at once will require careful positioning strategy and execution to make it work.

Home Depot's new attempt to occupy two market positions at once will require careful positioning strategy and execution to make it work. Verizon snags Peloton Interactive chief marketing officer Leslie Berland as its new CMO, effective Jan. 9. Berland succeeds Diego Scotti, who left Verizon earlier this year.

Verizon snags Peloton Interactive chief marketing officer Leslie Berland as its new CMO, effective Jan. 9. Berland succeeds Diego Scotti, who left Verizon earlier this year.  Norm de Greve, who has been CMO at CVS Health since 2015, is taking the top marketing job at General Motors, effective July 31.

Norm de Greve, who has been CMO at CVS Health since 2015, is taking the top marketing job at General Motors, effective July 31.

Have a comment? Send it to

Have a comment? Send it to

Nov. 17, 2022, by Bill Huey

Yes, don't scare people to death and don't talk down to them. Most already know they are unprepared for retirement and don't know what to do. That's why they are paying attention in the first place.