The COVID-19 pandemic resulted in off-the-charts digital media consumption around the world, with people increasing their interaction-time with social media platforms and consuming more content on streaming services, websites and apps than ever before. But growth in that sector appears to be waning, while participation in in-person media activities such as live events is set to increase, according to recent findings from market research firm YouGov.

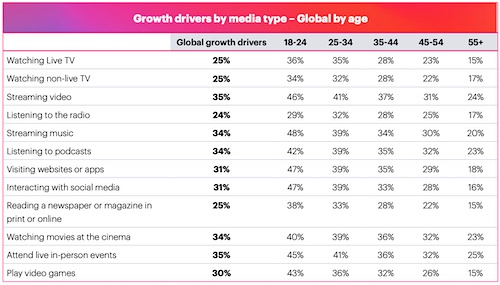

YouGov’s report, which polled respondents around the world regarding their media-consumption habits, found that digital media continued to exhibit the largest upticks in increased consumption during the past 12 months, with more than a third of global respondents claiming they’d spent more time accessing websites, apps, streaming services and interacting with social media in 2022 than they did the year before.

Almost all of those surveyed (95 percent) said they’d visited websites/apps in the last year, and 93 percent said they plan to continue doing so in 2023. Similarly, 88 percent reported using social media in 2022, and a similar proportion (86 percent) said they’re likely to continue this activity next year.

|

Websites and apps also registered the report’s highest “net growth score” in the last year—or the amount a media channel increased in use minus how much it lost during the same period—at 30 percent, followed by streaming video, at 21 percent.

However, the pandemic’s historic digital-media surge appears to be winding down. According to YouGov’s report, all digital media consumption registered lower projected “net growth” scores for the next 12 months when compared to this year. Web and app use is set to slow from 30 percent growth this year to 18 percent next year. Video streaming appears to have similarly plateaued, and will drop from 21 percent growth in 2022 to 13 percent in 2023. Streaming music is slated to drop from 14 percent growth to 11 percent, social media use will slow from 12 percent growth to seven percent and playing video games are expected to fall from five percent to one percent.

Meanwhile, in-person media events, which suffered some of the biggest blows during the pandemic, are set to experience something resembling a comeback. While seeing movies at a theater registered a negative “net growth score” of -22 percent this year and attending live events saw a similarly dismal -16 percent, cinemas are expected to see -5 percent “net growth” for the next 12 months, while live events registered -1 percent “net growth” for 2023.

Overall, despite some consumers remaining cautious when it comes to participating in in-person events, 40 percent of global respondents said they plan to attend more live events and make more trips to the cinema in the next year than they did in 2022.

Other forms of traditional media also signaled signs of a rebound, albeit modestly. Reading a newspaper or magazine is expected to swing from -2 percent “net growth” to +1 percent. Listening to the radio is also expected to see a comeback to +1 percent “net growth” from -2 percent.

According to the report: “When comparing the ‘net growth’ scores for all media activities in the last 12 months, we see a convergence of growth scores between digital and traditional media in terms of likely increased media consumption in the next 12 months, with digital consumption slowing and traditional media, including events and outdoor activities growing.”

YouGov’s latest Global Media Outlook report was based on a recent worldwide survey of more than 19,000 respondents living in 18 global markets. Surveys were collected in August.

Trump Media & Technology Group today reported a $58.2M net loss on $4.1M in 2023 revenues, a disclosure that drove its stock price down 22.6 percent to $47.96.

Trump Media & Technology Group today reported a $58.2M net loss on $4.1M in 2023 revenues, a disclosure that drove its stock price down 22.6 percent to $47.96. Barry Pollack, an attorney at Wall Street’s Harris St. Laurent & Wechsler, has registered Julian Assange as a client with the Justice Dept. “out of an abundance of caution.”

Barry Pollack, an attorney at Wall Street’s Harris St. Laurent & Wechsler, has registered Julian Assange as a client with the Justice Dept. “out of an abundance of caution.” Paramount Global to slash 800 jobs in what chief executive Bob Bakish calls part of an effort to “return the company to earnings growth"... Rolling Stone editor-in-chief Noah Shachtman is exiting at the end of the month due to disagreements with chief executive Gus Wenner over the direction the magazine is taking... The New York Times broke the $1 billion barrier in annual revenue from digital subscriptions in 2023... Press Forward is investing more than $500 million to strengthen local newsrooms.

Paramount Global to slash 800 jobs in what chief executive Bob Bakish calls part of an effort to “return the company to earnings growth"... Rolling Stone editor-in-chief Noah Shachtman is exiting at the end of the month due to disagreements with chief executive Gus Wenner over the direction the magazine is taking... The New York Times broke the $1 billion barrier in annual revenue from digital subscriptions in 2023... Press Forward is investing more than $500 million to strengthen local newsrooms. The majority of news articles are read within the first three days of publication, according to a recent report.

The majority of news articles are read within the first three days of publication, according to a recent report. The Los Angeles Times gives pink slips to 115 people or 20 percent of its newsroom staff... TIME is also laying off about 30 employees, which is approximately 15 percent of its editorial staff... The Baltimore Banner, which was launched by Stewart Bainum in 2022 after he failed to buy the Baltimore Sun, added 500 subscribers per day in the three days following Sinclair Broadcast Group's deal to purchase the Sun.

The Los Angeles Times gives pink slips to 115 people or 20 percent of its newsroom staff... TIME is also laying off about 30 employees, which is approximately 15 percent of its editorial staff... The Baltimore Banner, which was launched by Stewart Bainum in 2022 after he failed to buy the Baltimore Sun, added 500 subscribers per day in the three days following Sinclair Broadcast Group's deal to purchase the Sun.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.