|

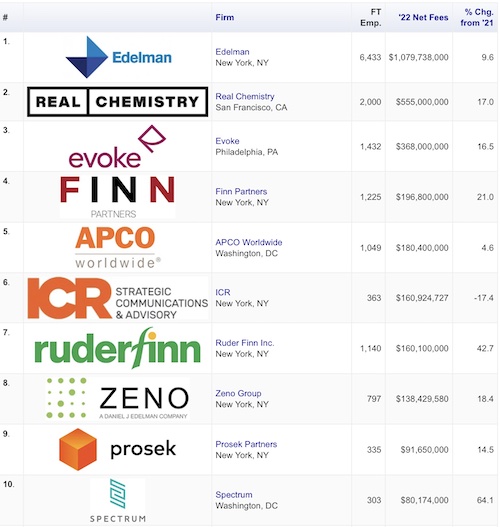

Healthcare PR firms registered a robust 24.8 percent jump in 2022 fee income to a combined $1.7B in 2022 as they counseled clients dealing with the after effects of the COVID-19 pandemic, according to O’Dwyer’s rankings.

Seven of the Top Ten firms posted growth, powered by a 103.3 percent surge to $368M at No. 2 Evoke Group and a 64.1 percent gain to $80.1M at No. 4 Spectrum.

The firms ranked seven through 10 posted declines in fee income. APCO Worldwide decreased 7.7 percent to $33.9M, ICR dipped 13.7 percent to $31.9M, imre fell 8.5 percent $31.2M and Crosby dropped 11.4 percent to $25.2M.

Finn Partners Adds 42 New Clients

|

| Gil Bashe |

Finn Partners’ healthcare unit posted 19.1 percent growth to $52.6M as the firm added 42 new clients and expanded into new markets via the acquisitions of SPAG (offices in India, Malaysia, Singapore and the Philippines) and Ireland’s Hyderus, which reaches into Europe, Africa and South America.

Gil Bashe, global health and purpose chair, said his unit tackled hot button issues such as the fragmentation of the health ecosystem and its cost in squandered resources and patient care.

He believes the firm is well positioned to guide clients successfully through this system-wide maze.

In 2022, Finn partnered with Galen Growth and issued a series of reports on “The State of Digital Health,” tapping into some 300 million data points across 14,000 global ventures.

Bashe said Finn Partners staffers worldwide worked closely with Fern Lazar, global health practice lead.

|

| O'Dwyer's ranking of the top ten healthcare PR firms based on 2022 net fee income. |

“Fern led knowledge-sharing initiatives by leveraging our continued investment in secure cloud-based IT infrastructure,” said Bashe.

Working in a hybrid environment, Lazar and colleagues hosted numerous global professional development summits in areas such as brand marketing, clinical trial patient recruitment, investor relations, integrated marketing, social media, scientific support, and corporate thought leadership.

The healthcare group launched several pro bono initiatives, including “The Heartbreak of the Heartland,” rural health effort that was acknowledged by the White House Biden Cancer Moonshot.

Bashe said the health unit’s emphasis on values, collaboration, innovation and a desire to tackle societal needs will power growth in 2023 and beyond.

Turning Away Potential Clients at M Booth Health

|

| Stacey Bernstein |

M Booth Health enjoyed a 33.9 percent hike in revenues to $21.9M, though it turned away three quarters of new business opportunities, according to CEO Stacey Bernstein.

That means 82 percent of growth was organic, achieved by expanding the range of services offered in the PA, marketing communications and social impact practices.

Bernstein, who joined the firm in January 2022 after a dozen years at Weber Shandwick, led the year of transformation with new leadership taking the helm.

Peter Matheson Gay joined from DXTRA Health as chief impact officer; Tayla Mahmud signed on as EVP, health equity and multicultural strategy from Havas Health & You; and Chaz Cox joined from Edelman as managing director, marketing communications.

M Booth Health underwent a rebrand in 2022, with a new value proposition of Choose to Challenge—built to help organizations and brands challenge norms, drive results and improve the lives and health of those who need it most, according to Bernstein.

Amid the changes, Bernstein said M Booth Health’s culture continued to thrive, as demonstrated by its 95 percent voluntary retention rate among staff.

The Bliss Group Builds on '22 Momentum

|

| Michael Roth |

The Bliss Group’s Healthcare Practice posted growth of 58.6 percent to $6.8M with 68m percent being organic and 32 percent via new clients.

Building on 2022 momentum, The Bliss Group and The Next Practices Group (NPG) launched NPG Health alongside its first firm, Bliss Bio Health (BBH).

The BBH offering is from “atom to access”, including marketing communications programs in early science, R&D research, medical education and advertising, commercialization, health programs and reimbursement.

It is led by Gloria Vanderham and Lisa Davidson as CEO and EVP, respectively.

“We have a responsibility to do better and offer unique approaches that promote clarity, collaboration and collective healthcare ecosystem progress. We will attract team members, partners and clients who want to be a part of the solution,” said Davidson.

In February, NPG Health launched CTRx Pathways following its work with Johns Hopkins School of Medicine to complete enrollment in two Covid-19 clinical trials.

CTRx Pathways is a platform that accelerates and diversifies clinical trial enrollment by combining analytics; paid, earned, shared and owned (PESO) media; and technology.

The New England Journal of Medicine featured CTRx in which both Michael Roth, chair, NPG Health Group, and Colin Foster, president, The Next Practice, were bylined alongside the Johns Hopkins team—demonstrating the power of insights-driven marketing communications on patient outcomes.

"The presence of healthcare marketing and communications teams who truly understand the science, patient experience and business of health—equally—is paramount to the evolution of the industry,” said Roth. “When we combine expertise within our teams, we are on the right path to achieving better outcomes in care.”

Year of Consolidation at APCO Worldwide

|

| James Tyrrell |

James Tyrrell, who heads APCO Worldwide’s global heathcare practice, called 2022 a “year of consolidation,” among its medical device and gene therapy client base in Europe, whose operations and business were particular affected by the pandemic business landscape.

Despite strong growth in North America, which was hightlighed by new assignments from with Mass General Brigham and the Hearing Industries Association, APCO’s health unit slipped 7.7 percent to $33.9M.

Tyrrell said cross-practice partnerships across insight generation, strategic partnerships and geo-commerce advisory supported overall growth in APCO pharma client base with new business wins including Pfizer, Takeda, Bayer, Alexion and Menarini.

Of particular note was high double-digit growth in the firm’s MENA health client base which saw APCO advise AstraZeneca on the organization of the first Global Kidney Health Summit on World Kidney Day at Expo Dubai, he noted. Following the success of the event, APCO was appointed to support the organization in developing policy strategies for AstraZeneca's core markets in EU, UK, Australia and Brazil.

In addition, the agency continues to undertake work supporting clients at the WHO, including the International Society for Thrombosis and Haemostasias on blood clot prevention, which was incorporated into the WHO resolution on Patient Safety.

“New wins and growth in assignments, in particular in our pharma and insurance business, demonstrates the appetite for our services and validates our current reach into our C-Suite relationships,” said James Tyrrell, chair of APCO’s Global Health practice. “Staying relevant and demonstrating our in-depth understanding of the issues facing the wider healthcare sector will be underpinning a number of new product offerings in 2023.”

Ruder Finn Pushes Boundaries to Drive Change

|

| Christie Anbar |

Ruder Finn Healthcare grew by 24.4 percent to $56M in 2022, fueled by organic growth and expanding its roster of innovative biopharma companies and NGOs, including Iveric Bio, Sage Therapeutics, PTC Therapeutics and FNIH, according to Christie Anbar, global lead, healthcare

“From redefining the pharma launch playbook, designing new ways to leverage strategic partnerships, and inserting brands into the mainstream cultural zeitgeist through influencer activations and new forms of edutainment, Ruder Finn is continuing to push boundaries to facilitate change that leads to better health outcomes,” she said.

Anbar said RF helped translate today’s communications trends into ROI-generating programs that "amplified the impact of our clients’ science and therapeutics."

The firm helped advance awareness and uptake of multiple breakthrough cancer and immunology drugs, as well as supported patients and families navigating the emotional side of living with chronic or life-threatening disease.

It supported numerous biotechs progressing new therapeutic modalities with potential for first-of-its-kind patient benefit in vision and hearing loss, sleep disorders and other unmet needs.

“Our work crosses the full patient and therapeutic journey, from communicating around critical milestones, to digitally targeted clinical trial recruitment, to community-building in discreet patient segments, to high-impact awareness and education campaigns including celebrities, KOLs, influencers, and attention-grabbing creative content such as serial podcasts and producing films for major streaming platforms,” said Anbar.

Crosby Records Solid Year in Challenging Environment

|

| Ray Crosby |

Crosby Marketing reported a solid year with very strong client and staff retention in 2022, according to CEO Ray Crosby, though fee income slipped 11.4 percent to $25.2M.

He said the No. 10 ranked healthcare firm drove record engagement for the Telehealth.HHS.gov website, strong membership growth for Blue Cross Blue Shield of Vermont, record online fundraising for Shriners Hospitals for Children, and generating more than $120 million in donated media for DAV (Disabled American Veterans) through a PSA campaign.

‘We also continued leading strategic communications for the U.S. Preventive Services Task Force, which puts us on the frontlines of promoting evidence-based preventive care and more equitable health for all,” said Crosby.

He said the firm remains focused on delivering powerful performance marketing solutions in the health care space, and clients really value our ability to connect the dots between patients, providers, payors, policy makers and advocacy groups.

Crosby said his firm is off to a “flying start” in 2023 as he projects 20 percent growth for the year.

Lo Isidro, senior director at Real Chemistry with more than a decade of strategic communications and PA experience, has joined Narrative Strategies.

Lo Isidro, senior director at Real Chemistry with more than a decade of strategic communications and PA experience, has joined Narrative Strategies. Nelson Fernandez, former North American chair of APCO Worldwide and managing director of Burson-Marsteller, has joined Volunteers in Medicine Berkshires as director of communications and PA.

Nelson Fernandez, former North American chair of APCO Worldwide and managing director of Burson-Marsteller, has joined Volunteers in Medicine Berkshires as director of communications and PA. Lilit Bargar, who was most recently an EVP in the healthcare practice at Weber Shandwick, comes on board at GCI Health as EVP, corporate practice lead.

Lilit Bargar, who was most recently an EVP in the healthcare practice at Weber Shandwick, comes on board at GCI Health as EVP, corporate practice lead.

Five ways that successful thought leaders are made.

Five ways that successful thought leaders are made.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.