Research recently published by New York-based financial agency Vested analyzed Millennials’ banking habits as well as what financial services they’re more inclined to use, providing some keen insights into this generation’s attitudes concerning money and what factors influence the often-elusive demographic when selecting a banking product.

A key finding: Millennials don’t trust big banks very much. Less than half — 46 percent — admitted visiting a bank in the last month, and only 20 percent said they trusted these institutions. In fact, the banking sector is trusted so little by the Gen Y demographic, most polled said they lend more trust to the press and government by comparison.

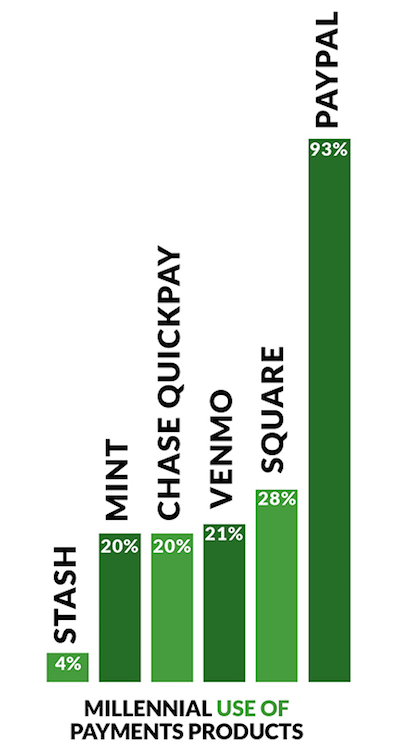

On the other hand, more than a third — 34 percent — admitted an allegiance to “big tech” (companies like Apple, Amazon, Facebook and Google), which ranked significantly higher than any other institution listed. Millennials also exhibit unusually higher levels of trust regarding new banking technologies than older generations: 93 percent said they had used PayPal, which was easily ranked the most popular online payment medium used. Less than a third — 28 percent — said they’d used mobile payment company Square, 21 percent said they’d used Venmo and 20 percent said they’d used both Chase QuickPay and Mint. Only four percent said they’d used micro-investing company Stash.

|

A vast majority of Millennials surveyed — 88 percent — said they’re more willing to adopt innovative banking products if they’re offered perks, premiums or loyalty points. And data safety was cited as Millennials’ top reason for choosing a banking product, at 32 percent, followed by convenience, at 26 percent. More than 60 percent said social media sites have not influenced their decision to use a new banking product.

38 percent of Millennials polled said debit cards are their primary source of payment, and nearly the same number — 34 percent — said they rely on credit cards for this purpose. 19 percent said they use PayPal for most transactions. When asked how they ideally prefer to pay for something, these three mediums yielded almost equal scores (28 percent, 28 percent and 29 percent, respectively).

The highest percentage of users polled — 32 percent — said convenience accounted for their preferred payment medium of choice. Cash was favored by only 12 percent of respondents.

Strangely, while readily admitting a distrust of banking institutions, nearly 60 percent of respondents said they wouldn’t use an online bank if it didn’t also have a brick-and-mortar counterpart.

Vested’s Millennial Money Study surveyed more than 400 U.S. adults between the ages of 20 and 35. 65 percent of respondents claimed to be employed full-time.

Edelman handles Viking Holdings, the river and ocean luxury cruise line that plans to raise $1B via an IPO priced in the $21 to $25 per share range.

Edelman handles Viking Holdings, the river and ocean luxury cruise line that plans to raise $1B via an IPO priced in the $21 to $25 per share range. Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management.

Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management. Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield.

Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield. Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office.

Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office. Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range.

Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.