Most dealmakers expect an increase in M&A activity in 2015 but not on the scale of the blockbuster activity of 2014, according to Brunswick Group.

Brunswick queried 115 top M&A advisors around the world for its annual study, finding 54% forecast an increase in deals for this year.

Brunswick US senior partner Steve Lipin said dealmakers have "high hopes" for 2015 but are less bullish about eclipsing 2014's $3.5 trillion tally. Lipin said increased influence by activist shareholders will likely mean more divestitures, break-ups and spinoffs, in addition to sales and acquisitions.

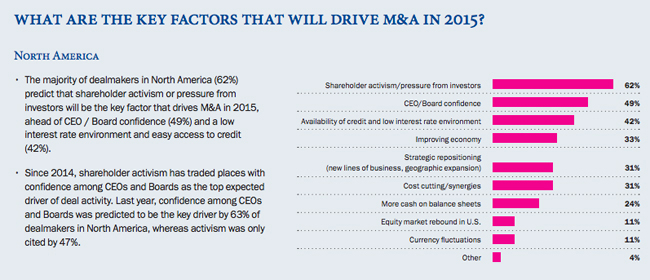

Sixty-two percent cited activists as the top factor driving M&A in North America, while 73% see shareholder activism increasing in the region this year. Brunswick notes that only 28% cited activists as main drivers of M&A in 2012.

A byproduct of the activism could be increased engagement between boards and investors as 85% dealmakers polled by Brunswick see this result. Compared with 2014, dealmakers see an increase in M&A demands by shareholders (11%, up from 3% in 2014) , a slight dip in spinoffs, sales or divestitures (34% from 39%) and a slight increase in activist demands for board seats (28%, up from 27%).

The most active sectors for consolidation are seen as healthcare (65%), energy (59%) in North America, and technology/telecom (81%) and healthcare (75%) in Europe. Asian dealmakers are focused on consumer goods and retail for consolidation this year.

Spectrum Science acquires clinical trial recruitment and engagement solutions provider Continuum Clinical.

Spectrum Science acquires clinical trial recruitment and engagement solutions provider Continuum Clinical. How PR agency owners can navigate the M&A process in a way that yields a rewarding experience for both owners and the teams they leave behind.

How PR agency owners can navigate the M&A process in a way that yields a rewarding experience for both owners and the teams they leave behind. Ten potential ways an agency sale can positively benefit team members and employees.

Ten potential ways an agency sale can positively benefit team members and employees. Kekst CNC reps Palladium Equity Partners and its joint venture affiliate, Palladium Heritage, on the acquisition of National Auto Parts, USA;, NAP San Diego; and National Auto Parts-Oakland to form Collision Auto Parts, a platform serving customers in the automotive aftermarket collision repair sector.

Kekst CNC reps Palladium Equity Partners and its joint venture affiliate, Palladium Heritage, on the acquisition of National Auto Parts, USA;, NAP San Diego; and National Auto Parts-Oakland to form Collision Auto Parts, a platform serving customers in the automotive aftermarket collision repair sector. ICR has acquired Bullfrog + Baum, the 23-year-old PR shop focused on the hospitality, lifestyle, travel and consumer marketing sectors.

ICR has acquired Bullfrog + Baum, the 23-year-old PR shop focused on the hospitality, lifestyle, travel and consumer marketing sectors.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.