The pending takeover of debt-ridden Cablevision by Altice could lower prices to subscribers. Cablevision execs have been living high on the hog, 300 of them getting $300K in pay while driving debt to $7.43 billion. Altice wants to shave $900M in costs and introduce the “quadruple play.”

The pending takeover of debt-ridden Cablevision by Altice could lower prices to subscribers. Cablevision execs have been living high on the hog, 300 of them getting $300K in pay while driving debt to $7.43 billion. Altice wants to shave $900M in costs and introduce the “quadruple play.”

Cable companies in Europe have been offering a package of four services--TV, phone, web and wireless. U.S. companies thus far only offer the first three—the “triple play.”

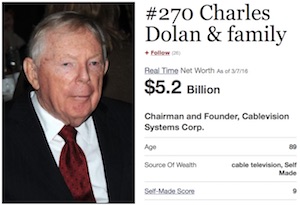

The Dolan family, headed by Charles Dolan, 89, spun off the money-losing cable operations in 2010 to separate them from cash cows Madison Square Garden, AMC Networks and the Knicks and Rangers sports teams.

The Dolan family, headed by Charles Dolan, 89, spun off the money-losing cable operations in 2010 to separate them from cash cows Madison Square Garden, AMC Networks and the Knicks and Rangers sports teams.

Altice executives headed by founder Patrick Drahi blasted the “many layers” of Cablevision management at a Goldman Sachs conference call Sept. 17, 2015.

Altice CEO Dexter Goei referred to the 300 staffers earning more than $300K. Drahi was quoted as saying, “I don’t like to pay salaries. I pay as little as I can.”

On the block would be a number of Cablevision’s 13,656 full-time employees and 800 part-timers. A 20% cut in staff, currently costing $1.3B, could save $260 million, said analyst Amy Yong of Macquaries Securities. The deal is espected to close in the first half.

Newsday Could Be Off-Loaded or Digitized

|

|

|

|

Morgan Stanley analyst Ben Swinburne said money-losing Newsday and the News 12 local TV networks might have to be shut down to stem the losses. Observers note that since no buyers have been found for the New York Daily News in a year of trying, it is unlikely that any could be found for Newsday. Another option is converting it to online-only.

New York City has told the New York State Public Service Commission that the deal raises “key public interest questions.”

Fair Media Council, a group of 200 corporations and non-profits on Long Island, is waging an all-out battle against the sale to Altice, saying it poses a “grave concern for the public interest, public safety and the local economy.”

It estimates the debt load at $15 billion and says “It is incomprehensible that such a high-risk sale shall be approved for one of the region’s biggest employees with nearly 14,000 employees and an economic engine for New York.”

Jaci Clement, CEO of FMC, said the deal is also opposed by the City of New York and the Communications Workers of America. FMC is based in Bethpage, also the corporate h.q. of Cablevision.

Altice Runs Lean Operations

Numericable, the French cable company of Altice, spends only $14 a month per customer while Cablevision spends $49. Suddenlink, a U.S. cable system that Altice bought last year for $9B, spends $32 per customer.

Part of the $900M in cost savings would come by combining some operations of the smaller Suddenlink (1.7M subscribers) and Cablevision, Altice said.

The company has obtained financing commitments from JP Morgan, BNP Paribas and Barclays. BC Partners and CPP Investment Board have an option to participate for up to 30% of the equity of Cablevision.

Altice would have to pay Cablevision $560M if it backs out and Cablevision would have to pay $280M to Altice if it withdraws, according to a filing with the Securities & Exchange Commission.

Sale Called “A Real Positive Force”

Philippe Dauman, president/CEO of Viacom, called the proposed sale “a real positive force.” He said the purchase of U.S. cable companies by Altice allows it to “leverage technology across a broader scale” and bring together smaller companies that “couldn’t make that kind of investment.”

Evercore ISI Research said Altice thinks it can improve the margins of the smaller cable companies.

NYT Urges Purchase of Cable Boxes

The New York Times, in an editorial Feb. 8, supported passage of a rule that would let cable customers buy their cable boxes, saving a average of $231 a year. Cable companies oppose the change. NYT notes that telephone companies in 1983 were forced to let customers buy the phones instead of having to pay monthly rent.

Monthly cable box charges have risen 185% since 1994, says the Consumer Federation of America.

Drahi Tries to Avoid Limelight

Altice founder Drahi “appears to guard his privacy closely and avoids interaction with the media,” says a three-page essay on him and his family in wealthx.com.

However, this is going to be difficult as his company strives to become a major and even dominant player in U.S. telecommunications.

Major media including the New York Times, Wall Street Journal, Forbes and Bloomberg as well as many smaller media have already delved into practically every corner of his life.

NYT's Nicola Clark had an extensive interview with him Sept. 7, 2015.

He was born in Morocco in 1953 to a Jewish family “but does not participate in the Jewish community in France or Europe,” says wealthx.com. He is “too busy” focusing on his business. “Nevertheless, most of Drahi’s philanthropy and donations are channeled toward Jewish causes in Israel,” it adds.

Drahi moved to southern France at age 15 with his parents, who were mathematics teachers, and “distinguished himself as a science student.” He obtained a B.A. in engineering from Ecole Polytechnique in Paris and an M.A. in Optics and Electronics in 1986 from Ecole Nationale Superieure des Telecommunications.

While still a graduate student, Drahi met “Lina,” an Orthodox Christian from Syria who was a medical student. Before the evening was over, he proposed to her, says the NYT article. They have four grown children.

Drahi gained initial experience in telecommunications in the U.S. and returned to France where, with the aid of borrowed money, he began assembling his empire.

A student loan of the equivalent of $9,000 helped him start his first cable company, Sud Cable Services, in 1994.

No U.S. Press Contacts for Altice

Arthur Dreyfuss is listed as the “media contact” at Altice. A telephone number with the country code of “41” (Switzerland) is given as well as an email address on the company website. He has not responded to an email.

Also not responding is Nick Brown, listed as head of investor relations with a “41” telephone number and an email. An extensive contact form for press inquiries is provided by Altice. Reporters can ask to be put on the distribution list for releases and can pose questions to the PR and IR staff via the form.

The form was filled out and questions posed last week but there has been no response. There have been no press conferences in Europe or the U.S. on the proposed merger.

Trump Media & Technology Group today reported a $58.2M net loss on $4.1M in 2023 revenues, a disclosure that drove its stock price down 22.6 percent to $47.96.

Trump Media & Technology Group today reported a $58.2M net loss on $4.1M in 2023 revenues, a disclosure that drove its stock price down 22.6 percent to $47.96. Barry Pollack, an attorney at Wall Street’s Harris St. Laurent & Wechsler, has registered Julian Assange as a client with the Justice Dept. “out of an abundance of caution.”

Barry Pollack, an attorney at Wall Street’s Harris St. Laurent & Wechsler, has registered Julian Assange as a client with the Justice Dept. “out of an abundance of caution.” Paramount Global to slash 800 jobs in what chief executive Bob Bakish calls part of an effort to “return the company to earnings growth"... Rolling Stone editor-in-chief Noah Shachtman is exiting at the end of the month due to disagreements with chief executive Gus Wenner over the direction the magazine is taking... The New York Times broke the $1 billion barrier in annual revenue from digital subscriptions in 2023... Press Forward is investing more than $500 million to strengthen local newsrooms.

Paramount Global to slash 800 jobs in what chief executive Bob Bakish calls part of an effort to “return the company to earnings growth"... Rolling Stone editor-in-chief Noah Shachtman is exiting at the end of the month due to disagreements with chief executive Gus Wenner over the direction the magazine is taking... The New York Times broke the $1 billion barrier in annual revenue from digital subscriptions in 2023... Press Forward is investing more than $500 million to strengthen local newsrooms. The majority of news articles are read within the first three days of publication, according to a recent report.

The majority of news articles are read within the first three days of publication, according to a recent report. The Los Angeles Times gives pink slips to 115 people or 20 percent of its newsroom staff... TIME is also laying off about 30 employees, which is approximately 15 percent of its editorial staff... The Baltimore Banner, which was launched by Stewart Bainum in 2022 after he failed to buy the Baltimore Sun, added 500 subscribers per day in the three days following Sinclair Broadcast Group's deal to purchase the Sun.

The Los Angeles Times gives pink slips to 115 people or 20 percent of its newsroom staff... TIME is also laying off about 30 employees, which is approximately 15 percent of its editorial staff... The Baltimore Banner, which was launched by Stewart Bainum in 2022 after he failed to buy the Baltimore Sun, added 500 subscribers per day in the three days following Sinclair Broadcast Group's deal to purchase the Sun.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.