Alcohol consumption trends have evolved dramatically in recent years, forcing marketers who represent brands in the beer, wine and spirits world to stay apprised of the constant ebbs and flows in recreational drinking culture.

While drinking culture is always changing in America, a fact remains: America is a boozy country. Alcohol consumption has increased steadily in the United States in the past several decades, according to data published by the National Institute on Alcohol Abuse and Alcoholism, an agency within the U.S. National Institutes of Health. Per capita ethanol consumption for the NIAA’s most recent survey year was 2.51 gallons, representing a 2.9 percent increase in alcohol consumption from the year prior and a 5.5 percent increase from the year before that, accounting for the largest two-year increase since 1969, an uptick undoubtedly influenced by the COVID-19 pandemic.

Interestingly, NIAAA data also shows that Americans are now drinking more hard liquor and wine, while the consumption of beer, typically the largest share of the U.S. alcohol market, has slipped below spirits for the first time since the NIAA began gathering this data.

But these trends don’t tell the entire story. A growing number of Americans are also choosing to drink less, while others have grown more flexible in their definition of what it means to abstain. The “California sober” trend, a term popularized by pop star Demi Lovato to mean abstinence from drugs and alcohol with the allowance of various exceptions—typically marijuana—has gained popularity in recent years, as detailed in a February 4 New York Times report on how the definition of sobriety is now evolving to include cannabis, ketamine and psychedelics (much to the consternation of some medical professionals).

Interestingly, an increasing portion of Americans are now also choosing to abstain entirely from alcohol—and research suggests that younger Americans in the Gen Z and Millennial generations are mostly responsible for driving this trend.

A recent survey by New York-based ad tech company NCSolutions shows just how much this sober cohort has grown in recent years. The survey, which asked Americans about their drinking habits and preferences, found that while more than two-thirds of Americans ages 21 and older (67 percent) identify themselves as social drinkers—and a majority (84 percent) still believe that drinking remains a major part of the national culture—Americans are now consuming, on average, three drinks per week, down from four per week last year.

In fact, nearly half (41 percent) of Americans said they plan to drink less in 2024, up from the 34 percent who’d similarly said they’d wanted to cut back on alcohol during a similar survey conducted last year. In total, more than a quarter (28 percent) of U.S. adults said they didn’t drink any alcohol at all last year.

Additionally, more than a third (34 percent) of those surveyed identified themselves as “mindful” drinkers, or those who moderate their alcohol consumption, be it how many drinks they have in a week or a single night. And nearly a quarter (22 percent) of Americans reported participating in last year’s alcohol-free challenge known as Dry January, up 10 percentage points from 2022.

|

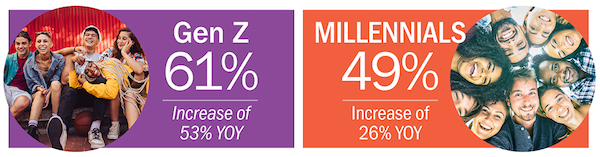

| Sober-curious generations: 61 percent of Gen Z and 49 percent of Millennials say they plan to drink less alcohol in 2024 |

So, why the change? The main reasons Americans are putting down in the bottle include desiring improved physical health (58 percent), wanting to save money (50 percent) and drinking less as part of a larger lifestyle change (47 percent).

These sober-curious and mindful drinkers largely belong to the Generation Z and Millennial cohorts. Nearly two-thirds (61 percent) of Gen Z respondents reported that they plan to drink less in 2024, accounting for a gain of more than 50 percent from the 40 percent who said the same last year.

Millennials aren’t far behind. 49 percent of this cohort said they plan to drink less in 2024, a 26 percent change from the year prior. On average, Millennials have gone from consuming five alcoholic drinks per week in 2023 to three in 2024.

Either way, this evolving recreational drinking culture suggests that nonalcoholic alternatives such as mocktails will continue to be a major trend in 2024. Indeed, more than a third of those surveyed tried a nonalcoholic drink such as a mocktail, nonalcoholic beer, nonalcoholic spirits, nonalcoholic wine or THC or CBD-infused drinks in 2023.

It also suggests that marketers in the beverage world may need to update their game when engaging with consumers in 2024 and beyond.

“The sober curious movement reflects a significant shift in lifestyle choices driven notably by younger generations,” NCSolutions CEO Alan Miles told O’Dwyer’s. “It presents a unique opportunity for CPG marketers to engage with this younger demographic and foster lasting brand loyalty. We see many of our beverage clients are already adapting and innovating with non-alcoholic beverage options to meet this evolving consumer demand.”

Hanna Lee, President and Founder of Hanna Lee Communications, a PR agency specializing in hospitality and travel, told O’Dwyer’s that not only have hospitality brands embraced alcohol-free alternatives—it’s the bar community that’s leading that sober-curious movement.

In 2015, Lee’s agency helped launch Seedlip, the world’s first non-alcoholic spirit in the U.S. Since then, according to Lee, many more companies have followed suit with an array of flavorful, non-alcoholic ingredients for bartenders to experiment with.

“Non-alcoholic cocktails have really developed over the last several years,” Lee said. “At the same time, next-generation consumers are moderating their consumption of alcohol. So, it is more than a trend, it is a societal movement, and the sky is the limit.”

Lee said that all of her agency’s New York-based bar and restaurant clients now offer non-alcoholic cocktails—as do many of its clients elsewhere—and that bartenders today have fully embraced the non-alcoholic drink category and are putting as much creativity and effort into them as they do their full-proof cocktails.

“We see bartenders playing a critical role, since they are educators and tastemakers. Bartenders are at the forefront of pioneering this category and bringing consumers along,” Lee said. “Now, whether you consume alcohol or not, you are treated as an equal at the bar and need not feel left out. This exciting movement will continue for many years to come and make socializing more inclusive, whether at a bar, restaurant or home entertaining.”

Influencers also appear to be big movers in the sober-curious world. According to the NCSolutions survey, nearly quarter 24 percent of Gen Z said they’d tried a nonalcoholic drink because a celebrity or influencer endorsed it, and more than a third (34 percent) said they're more likely to try a product if it’s marketed to align with the sober-curious lifestyle.

Not surprisingly, social media was named as the top advertising channel through which Gen Z consumers hear about new nonalcoholic beverages (45 percent), followed by Internet searches (16 percent) and streaming TV (15 percent).

NCSolutions' Consumer Sentiment Survey polled more than 1,000 U.S. adults in December 2023. Research was conducted by Researchscape.

What the biggest meal of the day can teach us about serving up effective nutrition communications campaigns.

What the biggest meal of the day can teach us about serving up effective nutrition communications campaigns. Tips to refine and amplify your CPG brand strategy to win in 2024 and beyond.

Tips to refine and amplify your CPG brand strategy to win in 2024 and beyond. Strategic communications strategies for success in the growing “food is medicine” movement.

Strategic communications strategies for success in the growing “food is medicine” movement. How brands can authentically communicate sustainability issues and create a brand experience that’s compatible with consumers’ values.

How brands can authentically communicate sustainability issues and create a brand experience that’s compatible with consumers’ values. Communicating the effects that climate change and a growing world population have on our food system—and why change is needed.

Communicating the effects that climate change and a growing world population have on our food system—and why change is needed.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.