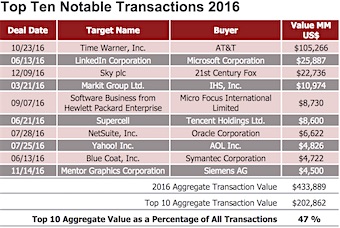

Acquisitions conducted by Time Warner over AT&T ($105,266B), Microsoft over LinkedIn ($25,887B), and 21st Century Fox over Sky ($22,736B) accounted for $153.9 billion, which is slightly more than one-third of the information industry’s aggregate mergers and acquisition value during 2016, according to Berkery Noyes investment bank.

|

Other top transactions were IHS buying Markit Group ($10,974B), Micro Focus Int’l buying software business from Hewlett-Packard Enterprise ($8,730B), Tencent Holdings buying Supercell ($8,600B), Oracle buying NetSuite ($6,622B), AOL buying Yahoo ($4,826B), Symantec buying Blue Coat ($4,722B), and Siemens AG buying Mentor Graphics ($4,500B).

Key trends include an 11 percent increase in e-commerce volume in the online and mobile horizontal, four percent increase in the consumer software volume in the software horizontal and four percent increase in the entertainment content volume in the media and marketing horizontal.

Sixty-six percent of all information industry transactions involved a target company which conducts the majority of their business online.

Total transaction value in 2016 rose to $433.89 billion, a 27 percent increase year-over-year.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.