|

| SEC Chair Gary Gensler |

The Securities and Exchange Commission on May 31 charged SCWorx Corp and its former CEO Mark Schessel with making false and misleading claims on an April 13 press release about the New York company’s plan to distribute COVID-19 rapid test kits.

The complaint alleges that SCWorx falsely stated that it had a committed purchase order for two million kits.

The order, according to the release, had “a provision for additional weekly orders of two million units for 23 weeks, valued at $35M per week.”

Following the issuance of the release, SCWorx’s stock surged 425 percent from the prior trading day on volume of 96.2M shares, which was more than 900 times the prior three-month average daily volume, according to the SEC.

The SEC alleges that Schessel and SCWorx issued the release despite having neither a legitimate supplier of COVID-19 test kits nor an executed purchase agreement with a buyer.

The complaint also alleges that Schessel and SCWorx publicly repeated the false and misleading statements about the distribution of COVID-19 rapid test kits over the course of April 2020.

"We allege that the defendants engaged in an age-old fraud—lying about their business prospects—to capitalize opportunistically on the COVID pandemic," SEC Chair Gary Gensler said in a statement. "As the challenges from the pandemic continue, investors should be vigilant about COVID-related claims. The SEC will continue to root out fraud and prosecute those who attempt to use the surge of uncertainty from the pandemic to defraud the investing public."

SCWorx has agreed to a settlement, subject to court approval, that includes permanent injunctions, the payment of a $125,000 penalty, and disgorgement of $471,000 with prejudgment interest of $32,761.56.

As PR firms fall over themselves setting up cannabis practices to cash in on the legalized marijuana market, a British speciality drug company stands ready to treat potheads.

Indivior and its French partner Aelis Farma on May 31 enrolled its first patient in a Phase 2 study for its synthetic inhibitor drug to treat cannabis use disorder (CUD).

It hopes to win the first US approval for a medicine to treat excessive marijuana use.

Cannabis is the No. 3 misused substance after alcohol and tobacco.

About 50M Americans used cannabis in 2020 and 14M of them had CUD.

Indivior CEO Mark Crossly told the Financial Times that “there is going to be a huge opportunity for us to help people with this disorder, moving forward, especially with so many people nowadays seeing marijuana as a normalized space.”

UK’s Tulchan handles Indivior’s PR.

|

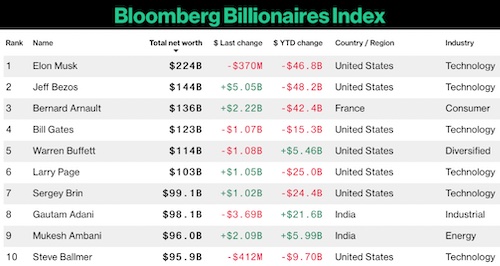

Concerned about your shrinking retirement fund? Don’t fret. It could be worse. You could be a billionaire.

Check out Bloomberg Billionaires Index for a scorecard on how the stock market swoon has ravished the wealth of the super affluent.

While the Dow Jones Industrial Average is down 10.3 percent this year, Bloomberg’s top billionaire, Elon Musk, is down 46.8B smackers to $224B because his investment portfolio is focused largely on Tesla.

Investors are spooked that Musk’s infatuation with Twitter will come at the expense of Tesla, which trades at $739.20. The stock has traded at between $571.22 and $1,243 during the past year..

No 2 billionaire Amazon’s Jeff Bezos, is down $48.3B to $144B and No. 4 Microsoft co-founder Bill Gates dropped $15.3B to $123B.

Facebook CEO Mark Zuckerberg tumbled to the No. 13 spot as his portfolio of Meta stock dipped $54.1B to $71.5B.

The billionaires, though, may have the last laugh as rising interest rates spread financial misery to the common folk.

The top one percent owns more than half of US stock and mutual funds, while the bottom 90 percent owns less than 12 percent.

It’s a different story when it comes to real estate.

The bottom 90 percent own more than half of the real estate, while the top one percenters control less than 14 percent, according to the Federal Reserve.

The National Association of Realtors on May 26 reported that pending home sales slid 3.9 percent in April, which was the sixth consecutive down month.

The Federal Reserve promises that interest rates are going to get higher.

Lawrence Yun, NAR’s chief economist, notes that higher mortgage rates are “even more problematic to a family on a budget contending with rapid inflation, including surging fuel and food costs.”

Hold tight, we’re in for some nasty weather.

Republican tough guys Josh Hawley and Tom Cotton want Biden to send the National Guard to Columbia University to put an end to student protests... Bernie blasts Bibi for insulting America's intelligence by equating criticism of Israel's government with antisemitism... German court convicts former financial PR exec who claims he wasn't aware that trading on tips is illegal.

Republican tough guys Josh Hawley and Tom Cotton want Biden to send the National Guard to Columbia University to put an end to student protests... Bernie blasts Bibi for insulting America's intelligence by equating criticism of Israel's government with antisemitism... German court convicts former financial PR exec who claims he wasn't aware that trading on tips is illegal.  Southern governors claim they know what's best for their working class, and it's not pay raises... A Ukrainian human rights group played a key role in convincing House Speaker Mike Johnson to hold a vote to send arms to Ukraine, Israel and Taiwan... Trump Media & Technology Group blames short-selling and not lousy outlook for its stock slump.

Southern governors claim they know what's best for their working class, and it's not pay raises... A Ukrainian human rights group played a key role in convincing House Speaker Mike Johnson to hold a vote to send arms to Ukraine, Israel and Taiwan... Trump Media & Technology Group blames short-selling and not lousy outlook for its stock slump. The techniques deployed by OJ Simpson's defense team in the 'trial of the century' served as a harbinger for those used by Donald Trump... People worry about the politicization of medical science just as much as they fret about another pandemic, according to Edelman Trust Barometer... Book bans aren't restricted to red states as deep blue Illinois, Connecticut and Maryland challenged at least 100 titles in 2023.

The techniques deployed by OJ Simpson's defense team in the 'trial of the century' served as a harbinger for those used by Donald Trump... People worry about the politicization of medical science just as much as they fret about another pandemic, according to Edelman Trust Barometer... Book bans aren't restricted to red states as deep blue Illinois, Connecticut and Maryland challenged at least 100 titles in 2023. The NBA, which promotes legalized gambling 24/7, seems more than hypocritical for banning player for placing bets... Diocese of Brooklyn promises to issue press release the next time one of its priests is charged with sexual abuse... Truth Social aspires to be one of Donald Trump's iconic American brands, just like Trump University or Trump Steaks or Trump Ice Cubes.

The NBA, which promotes legalized gambling 24/7, seems more than hypocritical for banning player for placing bets... Diocese of Brooklyn promises to issue press release the next time one of its priests is charged with sexual abuse... Truth Social aspires to be one of Donald Trump's iconic American brands, just like Trump University or Trump Steaks or Trump Ice Cubes. Publicis Groupe CEO Arthur Sadoun puts competition on notice... Macy's throws in the towel as it appoints two directors nominated by its unwanted suitor... The Profile in Wimpery Award goes to the Ford Presidential Foundation for stiffing American hero and former Wyoming Congresswoman Liz Cheney.

Publicis Groupe CEO Arthur Sadoun puts competition on notice... Macy's throws in the towel as it appoints two directors nominated by its unwanted suitor... The Profile in Wimpery Award goes to the Ford Presidential Foundation for stiffing American hero and former Wyoming Congresswoman Liz Cheney.

Have a comment? Send it to

Have a comment? Send it to

Jun. 2, 2022, by Joe Honick

If the SEC is so worried about press release honesty, why has it not said anything at all about the PR crap put out in behalf of political and entertainment "washouts" who are marketing all sorts of creams, oils and brain stuff?