|

| Rick Gould |

Gould+Partners conducts three major surveys annually: one on financial benchmarking, one on billing rates/utilization and one on industry growth. All participating firms are tracked by size and regions.

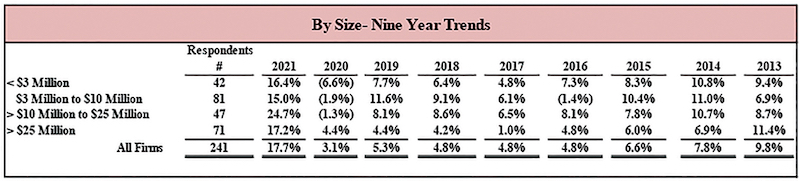

All three surveys this year arrived at the same conclusion: 2021, the post-COVID year, was incredible for most PR firms. PR firms grew in each of the four size categories and in each of the ten regions tracked in Gould+Partners’ annual surveys.

Our study provided excellent insight regarding the pulse of the industry and which size groups and regions are the fastest growing. 241 North American firms were included in the stats. The overall growth was 17.7 percent, up from 3.1 percent, pretty incredible in a post-pandemic year. The $10-$25 million firms grew the most rapidly: The 47 firms in this category grew 24.7 percent.

|

All ten regions we tracked had substantial growth. Northern CA (27.1 percent), Southwest (23.9 percent) and Southern CA (21.6 percent) were the top three. Below is a recap of the revenue growth of each of the 10 regions we track.

| This article is featured in O'Dwyer's Aug. Financial PR/IR & Professional Services PR Magazine (view PDF version) |

Second straight year for increased billing

For the second year in a row, PR firms increased billing rates, and utilization rates were consistent with the previous year. Our annual survey that focuses on revenue and cost metrics reinforced last year’s conclusion that PR agencies were laser-focused on maximizing billing rates and utilization.

|

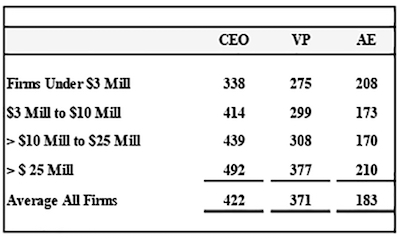

Our survey report found that average hourly CEO billing rates increased most dramatically at firms bringing in between $10–$25 million in net revenues annually, whose CEOs charged an average of $439 per hour in 2021, up from $388 in 2020. CEOs at the largest PR shops—or agencies boasting more than $25 million annually—billed an average of $492, compared to $483 in 2020. CEOs at firms with net revenues between $3–$10 million billed $414 per hour on average, compared to $400 in 2020. CEOs at the smallest firms polled—those with under $3 million in net revenues—billed at an average hourly rate of $338, up from $307. Billing for VPs and account managers was virtually flat. Billing for account executives was up, at $183 versus 2020’s $179, and account coordinators charged $149 versus 2020’s $143.

|

Our survey report disclosed that utilization, the metric by which productivity is measured, was treated by firms as a high priority. CEO and VP utilization is in line with our goals. AE utilization is below the goal, being at least 90 percent.

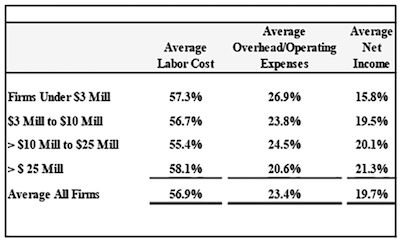

The profitability metrics indicate the size of firms does matter, that there are economies of scale that go to the bottom line. Although labor cost—which includes base salaries, benefits, payroll taxes and incidental labor costs—increases as firms grow, the economies of scale are with overhead. Fixed overhead percent decreases as revenue increases. Profitability increases as firms grow. Firms in excess of $10 million, on average, reach the 20 percent profitability goal. A major reason for this is that firms that bill mainly on retainer average higher retainers.

So, when we measure the valuation of a firm we must evaluate billing rates, utilization and average monthly retainers, in addition to the profitability of the firm and its year-over-year growth in net revenues.

***

Rick Gould is Managing Partner of Gould+Partners.

Edelman handles Viking Holdings, the river and ocean luxury cruise line that plans to raise $1B via an IPO priced in the $21 to $25 per share range.

Edelman handles Viking Holdings, the river and ocean luxury cruise line that plans to raise $1B via an IPO priced in the $21 to $25 per share range. Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management.

Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management. Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield.

Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield. Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office.

Tod Donhauser, a nine-year veteran of Edelman, has joined H/Advisors Abernathy as managing director and head of its San Francisco office. Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range.

Intelligent Group Ltd, a Hong Kong-based financial PR firm, has priced its initial public offering of 1.9M shares at $4, which is the low end of the $4 to $5 range.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.