|

| Dara Busch |

As inflation continues to impact spending, consumers are revisiting their list of what they’re willing to spend more of their money on. Luckily for those in the travel industry, experiences seem to be trending up on the “splurge” list.

A consumer survey conducted by 5W told us a lot about the path to purchase in the travel space. Let’s look at the survey results, along with some tips and tactics 5W recommends for brand marketers navigating the travel landscape.

The Travel/Splurge Landscape: At-A-Glance

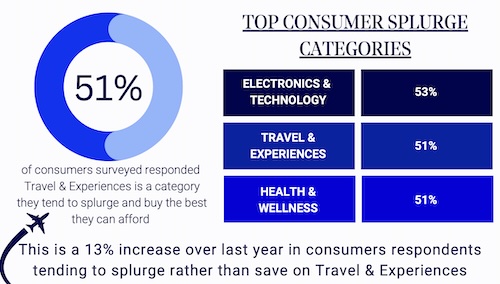

In November 2022, a little over one-third of consumers (38 percent) reported interest in splurging on travel. This year more than half of consumers (51 percent) showed an interest in splurging on travel and experiences. While more consumers are likely to spend in this area, brands must keep in mind that this doesn’t equate to unlimited splurging. Rather, consumers want the most bang for their buck; they’ll likely spend more when there is a great deal involved. 78 percent of consumers surveyed said inflation has impacted the way they go about choosing travel destinations—and 43 percent said it has impacted their choices significantly.

Traditional Search, New Discovery

The way consumers are searching for and discovering travel destinations and experiences hammers home the need for a multi-pronged communications strategy. Specifically, brands should have a multi-channel media approach that hits consumers at various points throughout their purchase journey.

|

According to 5W’s survey, word-of-mouth is the top channel consumers report using to discover a travel experience (46 percent) and further research a trip (40 percent). However, word-of-mouth comes with a caveat now: Because our digital and real lives are so intertwined, the line between friends and followers can become blurred. With so many brands being pushed at them IRL and online—from friends and influencers—consumers may mistakenly cite a social media recommendation as WOM.

Social media is critical to discovery in the travel space; 41 percent of consumers report YouTube as their go-to for travel discovery, while 31 percent says Instagram and 29percent opt for Tik Tok. Researching a desired trip is another story, however, and one that clearly speaks to why a multimedia approach is so crucial.

How? YouTube remains a favored tool when it comes to travel research (37 percent). However, the stark difference shows up here as Tourism Board Websites (28 percent) and Travel Publications (26 percent) immediately follow. The list of top research tools then shifts back to social media with TikTok (26 percent) and Instagram (25 percent), but in totality this ranking shows that traditional media is most definitely not dead. Traditional travel media certainly has time to shine–but like any approach, it needs to be one part of a well-rounded communications plan. Moreover, the competition between channels is so close, with no clear platform favorite, making it critical for travel and experience brands to ensure they are engaging consumers on all platforms.

Timing Is Everything

5W’s consumer travel survey revealed invaluable insights into a consumer’s typical timeframe when it comes to pulling the trigger on a trip. Six months to a year seems to be the sweet spot, with 35 percent of consumers identifying this as the timeframe when they begin researching their vacation or experience. Additionally, 54 percent of consumers spend more than four hours—and up to eight—planning their experience. That’s a lot of open time media brands can leverage to make themselves noticed.

Despite all of this, inflation is still impacting spending, and travel is a category affected most by external expenses (transportation, etc.), so experiences and destinations will still face challenges, especially if they don’t have the right multichannel approach in place.

The consumer travel survey conducted by 5W can be found here. Along with these insights and recommendations, we recommend brands contact 5W PR for more ideas on how to activate in the travel category.

***

Dara Busch is Co-CEO of 5WPR.

The research was conducted by Censuswide with 1,003 respondents aged 18+ across the USA between 9.19.23 and 9.22.23. Censuswide abides by and employs members of the Market Research Society which is based on the ESOMAR principles and are members of The British Polling Council.

Weber Shandwick is providing PR and marketing communications services to the Moroccan National Tourist Office in New York.

Weber Shandwick is providing PR and marketing communications services to the Moroccan National Tourist Office in New York. Finn Partners has filed its six-month contract with the Bahamas Ministry of Tourism, Investments & Aviation, which is worth $240K.

Finn Partners has filed its six-month contract with the Bahamas Ministry of Tourism, Investments & Aviation, which is worth $240K. Weber Shandwick wrapped up its work for the Ministry of Bahamas at the end of 2023.

Weber Shandwick wrapped up its work for the Ministry of Bahamas at the end of 2023. The Aruba Tourism Authority is boosting its budget 29.4 percent to $2.2M at Zeno Group, according to its 2024 contract, effective Jan. 1.

The Aruba Tourism Authority is boosting its budget 29.4 percent to $2.2M at Zeno Group, according to its 2024 contract, effective Jan. 1. Lou Hammond & Assocs. has inked a two-year contract to drive awareness in the US and Canada about the tourism attractions offered by Dubai.

Lou Hammond & Assocs. has inked a two-year contract to drive awareness in the US and Canada about the tourism attractions offered by Dubai.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.