|

The pace of mergers and acquisitions in the public relations and integrated marketing communications sector shows little sign of slowing down, according to a survey just released by legal firm Davis & Gilbert.

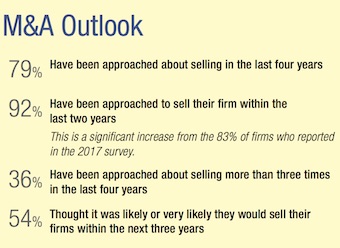

Out of the 109 firms that responded to the survey, 92 percent indicated that they had been approached by a potential buyer in the last two years. More than half (54 percent) said they thought it was likely or very likely that they would sell their firm within the next three years.

The top three reasons cited for contemplating a sale were reaping a personal financial reward for the seller, executing a personal exit strategy or gaining the opportunity to take on greater challenges in a larger firm.

|

The most attractive buyers from a seller’s point of view were large independent PR firms, with large publicly traded holding companies coming in second and small or midsized PR firms occupying third place. Consulting firms and private equity firms ranked much further down the scale than they did in last year’s survey.

Those rankings are a pretty good reflection of the 67 M&A transactions that Davis & Gilbert identified over the 12-month period ending Oct. 1. Independent PR firms constituted 61 percent of the buyers in those transactions, with public holding companies accounting for 37 percent and private equity firms sitting at just two percent.

“The high volume of deal activity in which independent PR firms bought other firms represents a dramatic change from just a few years ago,” said Brad Schwartzberg, co-chair of Davis & Gilbert’s corporate practice group.

Not surprisingly, the most popular acquisition targets are firms that specialize in tech, which accounted for 39 percent of last year’s M&A deals. Among the other specialties attractive to buyers were travel & tourism, financial services/investor relations, healthcare and sports/enterainment.

The survey also asked firms to identify the top three challenges they faced over the past 12 months. Attracting and keeping top talent was tops on the list, and most firms said they expected that challenge to remain strong over the next 12-month period. Firms also cited the need for specialized talent, with an emphasis on mid- and senior-level employees who have business development and client management skills.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms. Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem

Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX.

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX. AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack.

AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack. A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.