North American PR agencies managed to stay profitable and witnessed healthy growth in 2022 in the face of changing marketing forces, according to results from an annual survey conducted by PR merger and acquisition consultancy Gould+Partners.

The Gould+Partners’ report, which tracked participating firms across 21 critical benchmarks, found that North American PR agencies in 2022 witnessed average operating profits—the key metric by which Gould valuates PR firms—of 18.7 percent, a slight downturn from 2021’s 19.7 percent but still ahead of 2020’s 18.2 percent and still above pre-COVID 2019’s 17.4 percent.

The largest PR shops—or agencies boasting more than $25 million annually—accounted for operating profits of 21.6 percent, a slight uptick from last year’s 21.3 percent. Firms bringing in between $10–$25 million in annual net revenues saw operating profits of 14.8 percent (compared to 2021’s 20.1 percent). Firms with net revenues between $3–$10 million saw operating profits of 18.4 percent (compared to 2021’s 19.5 percent). The smallest firms polled—those with under $3 million in net revenues—saw 2022 operating profits of 15.7 percent, which was effectively flat from 2021’s 15.8 percent.

|

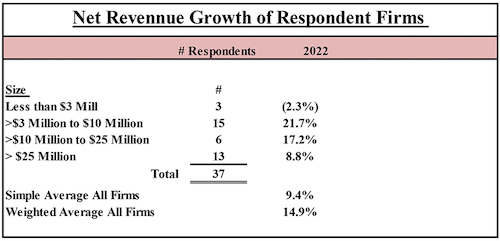

| Net revenue growth for North American PR agencies (broken out by agency size) in 2022. |

Things were especially rosy last year for the largest PR firms—those bringing in more than $25 million—because not only were their operating profits higher than in 2021, but 2022 operating profits percentages for these firms were also higher than their average overhead/operating expenses (19.9 percent). Gould+Partners Managing Partner Rick Gould told O’Dwyer’s that “This savings in overhead goes right to the bottom line.”

In fact, average overhead/operating expenses were slightly down for all agencies last year, at 22.2 percent (compared to 2021’s 23.4 percent).

Firms of all sizes surveyed in the study also saw higher revenues last year, according to the survey, revealing average net revenue growth—calculated as fees plus mark-ups—of 9.4 percent. Firms with net revenues between $3–$10 million saw the highest revenue growth in 2022 (21.7 percent). Firms accounting for between $10–$25 million saw net revenue growth of 17.2 percent. The largest PR shops—or agencies boasting more than $25 million annually—saw net revenue growth of 8.8 percent. The smallest firms polled—those with under $3 million in net revenues—grew at an average of 2.3 percent. According to Gould, these figures are “a very encouraging sign, especially in a period of high interest rates and an uncertain economy.”

Perhaps as a result of this, average billing rates were up across the board for all staff at PR agencies last year. Presidents/CEOs billed an average of $451 per hour last year (compared to 2021’s $422). EVPs/SVPs billed an average of $381 (versus 2021’s $371). VPs billed an average of $333 (compared to 2021’s $319). Account managers charged $271 (vs. 2021’s $257). Senior account executives charged $234 (vs. 2021’s $215) and account execs charged $187 (vs. 2021’s $183).

Gould+Partners’ report also discovered that average account salaries were up last year for all firms as well (42.3 percent of net revenues, compared to 2021’s 40.6 percent), as were revenues per staff member ($226,085, versus 2021’s $223,458). Interestingly, revenues per staff were highest ($261,066) at the firms with the smallest revenues (less than $3 million). However, bonuses were highest (6.4 percent) at the agencies with the highest revenues (more than $25 million).

The Gould+Partners report also found that, among in ten regions ranked, PR firms stationed in the Washington D.C. area saw the highest operating profits in 2022 (24.7 percent), followed by firms located in Canada (24.4 percent), the U.S. Southeast (21.8 percent), the Midwest (19.6 percent), the NYC metro area (16.2 percent) and California (13.5 percent). The U.S. Northeast and Southwest bottomed out the list with a tie in operating profits (12.2 percent).

Net revenues were highest for firms stationed in California (24.4 percent), the Southeast (16 percent), the Northeast (14 percent) the Washington D.C. area (12 percent), the NYC metro area (9.3 percent), the Midwest (7.4 percent), the Southwest (5 percent) and Canada (4.7 percent).

Billing rates for these agencies, on the other hand, remained highest in the NYC metro area ($343 an hour), followed by the Northeast ($245 an hour), the Southwest ($225 an hour), the Midwest ($211 an hour), California ($210 an hour), the Washington D.C. area ($205 an hour), the Southeast ($203 an hour) and Canada ($190 an hour).

Gould+Partners’ “2023 Best Practices Benchmarking Report” was based on responses from 37 “model" PR firms in the U.S. and Canada. Responses were collected in May and were based on 2022 results.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms. Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem

Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX.

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX. AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack.

AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack. A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.