2023 has been a tough year for PR agencies. According to the latest findings in an annual report released by business development firm RSW/US, PR agencies this year have struggled on multiple fronts, citing smaller budgets, slower referrals and longer sales cycles as ongoing themes in 2023. And that’s not even the worst of it.

RSW’s annual report surveyed executives at marketing services firms and PR agencies in an attempt to take the temperature on industry trends and challenges as well as to gain insight regarding how business efforts have fared this year.

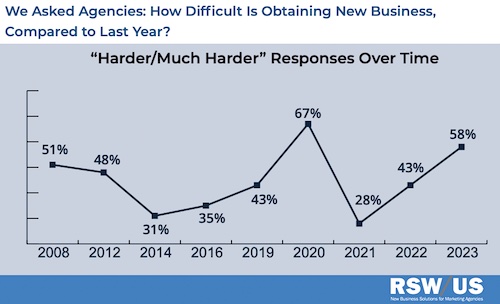

According to the report, 58 percent of agencies said obtaining new business this year has been harder. That’s a big leap from last year (when only 43 percent said business was tougher) and 2021 (when only 28 percent expressed difficulty finding new business). In fact, this year’s numbers are closer to 2020 levels (67 percent), a year when the industry was subjected to COVID-induced lockdowns, budget freezes and extreme economic uncertainty.

|

| 58 percent of PR agency executives said it has been more difficult to obtain new business in 2023, the highest percentage since 2020 (and third highest since 2008). |

Only seven percent of agencies said it’s been easier to obtain new business in 2023, versus 17 percent who said so in 2022 (and 38 percent in 2021). More than a third (38 percent) of agencies also reported a decrease in new business opportunities, whereas only 26 percent said the same last year. Only 29 percent said their agency has witnessed more new business in 2023, compared to 32 percent who said the same in 2022.

When asked if they’ve seen the dollar volume of new business opportunities increase, decrease or remain the same this year, 41 percent of agency executives reported a decrease, compared to 31 percent who said new business dollar volume remained flat and 27 percent who reported an increase. By contrast: in 2022, 37 percent of agencies reported an increase in new business dollar volume.

It’s also taking longer for agencies to close deals. Most agencies reported that the average amount of time it has taken for them to move from a first meeting to the dotted line in 2023 was somewhere between one and six months, which is more or less consistent with findings from previous iterations of RSW’s annual survey. However, the percentage of agencies reporting that it took them longer than six months to close a deal rose significantly in 2023, to 18 percent (from five percent in 2022), indicating that, like money, business timeframes are getting tighter as well.

So, what’s behind this slowdown? In the immortal words of James Carville: “It’s the economy stupid.” Or at least it could be. While it’s impossible to say exactly how much of the PR world’s downturn can be directly attributed to the current state of the economy, the RSW/US report revealed that many agencies at least see an obvious link. Despite early signs of improvement, stubborn inflation and ongoing fears of a forthcoming recession make it clear that the bounce-back that characterized agency activity during the post-COVID years of 2021 and 2022 is a thing of the past. Nearly half (45 percent) of agency executives believe that business is down at their agency due to the economy. Less than a third (28 percent) said they don’t think the economy has anything to do with it, while 19 percent cited the economy as a factor that has boosted their business.

Another indication that the economy has at least something to do with the marketing world’s current doldrums is the seemingly widespread belief that client budgets are down. When asked why it has been harder for agencies to obtain new business, most (61 percent) cited fewer client opportunities, followed by prospect budgets being too small (55 percent). Coming in at third was prospects being too hard to break through (47 percent). These responses break a years-running trend—as documented in previous versions of RSW/US’s annual report—where breaking through to prospects had always unilaterally been the biggest obstacle for obtaining new business. The fact that it comes in third place this year—with fewer opportunities coming in first for the first time, followed closely by shrinking budgets—is another suggestion that larger economic factors could be at play.

Other reasons agencies gave as to why business has faltered this year included prospects going dark (37 percent), an inability to connect with the right person (15 percent), clients not having a communications/marketing process in place (13 percent) or having no time to develop one (11 percent) and an inability to make the investment (five percent).

Referrals came in as the number-one new business generator for PR agencies this year. More than two-thirds of new communications business in 2023 has come from referrals (69 percent), followed by picking up business from existing clients (50 percent). Interestingly, a comparison with last year’s data reveals that referrals—which were 64 percent in 2022—have gone slightly down this year, and business from existing clients—59 percent in 2022—has gone up.

Other ways that agencies found business in 2023 included networking (46 percent), followed by conferences, presentations or speaking engagements (28 percent), organic search (20 percent), inbound marketing programs such as HubSpot or SharpSpring (15 percent), emails (14 percent) and paid search (seven percent).

The RSW/US 2023 “Agency New Business Report” surveyed 3,000 agency executives in the U.S. and Canada. The survey was conducted in September.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms. Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem

Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX.

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX. AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack.

AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack. A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.