|

Healthcare and life sciences companies are expecting artificial intelligence, along with other technological advances, to give the industry a boost in 2024, counterbalancing the effects of economic and political uncertainty.

That’s the conclusion of the U.S. Healthcare & Life Sciences Industry Outlook 2024 study recently released by FTI Consulting.

The general level of optimism of the respondents in the new survey was 68 percent, an 8 percent drop from last year. And while a solid 79 percent say they are optimistic about their own firm’s financial performance, that’s still down 8 percent from the 87 percent who said that in the last study.

The HCLS leaders still expect market activity to rise in most cases, though just slightly. About two-thirds (67 percent) think that M&A activity will go up, a 4 percent bump from last year. An even smaller hike (1 percent) is expected for IPO activity, which would hit 54 percent. A 2 percent drop in SPAC activity, to 48 percent, is predicted.

Several major risks may be contributing to the optimism slowdown. Foremost among them is general economic uncertainty, which was cited by 40 percent of respondents. Cybersecurity tied for second place on the list with talent scarcity (both at 24 percent), and declining reimbursement rates (21 percent) were also a major concern.

Half of the respondents (50 percent) said they feel vulnerable to a cyberattack or incident. Among the possible effects of cyberattacks to the industry, 56 percent cited data access/exposure, 49 percent said financial costs and 46 percent predicted an impact on patient care.

|

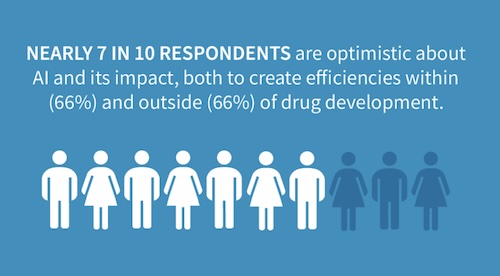

But technology also has its upside. Two-thirds of the respondents (66 percent) said that AI has the potential to create efficiencies within the drug development cycle, and an equal number say it could also positively affect the industry in areas other than drug development.

The survey also examined the effect of government policy on the financial outlook of the HLCS sector. The Biden administration’s impact on the sector is viewed positively by 49 percent of respondents, with 40 percent saying that the impact is a negative one.

The Inflation Reduction Act is also seen as both a good and bad influence. More than six in ten (62 percent) say the IRA will encourage the development and demand for vaccines, and 60 percent say it will do the same for biologics. But nearly as many (58 percent) predict that the IRA will result in more lawsuits being filed, due to its impact on business activity.

In addition, 25 percent think that the IRA will negatively affect patient access to and affordability of care, with 22 percent expecting it to slow down orphan drug development in 2024.

With 48 percent of the companies expecting their expenditures to rise next year, marketing is holding its position as an important part of that spending. While R&D is the top candidate for increased expenditures (48 percent), marketing is a close second (43 percent), with retaining (43 percent) and recruiting (42 percent) talent just behind.

The study was conducted by FTI Consulting’s Strategic Communications team between Oct. 9-18.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms. Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem

Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX.

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX. AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack.

AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack. A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.