|

While the number of M&A deals fell considerably overall in 2023, the number of those deals—and the leaks having to do with them—started an upward climb in the second half of the year, according to a report just released by H/Advisors Abernathy.

The H/Advisors Abernathy 2024 M&A Leaks Report found that 405 deals valuated at $1 billion or more were announced in 2023—an 18.5 percent drop from the 497 that took place in 2022. However, the report says that 25 percent more deals were announced in the second half of the year than in the first half.

The number of leaks inched up as well, hitting 26 percent of deals in the second half, up from 21 percent in the first half. For the year as a whole, 24 percent of deals leaked.

H/Advisors Abernathy discovered that, not surprisingly, some kinds of deals were more leak-prone than others. Almost half (47 percent) of the deals valued at $5 billion or more reported a leak last year, which the report says represents a 21 percent jump from 2022.

|

An increase in divestitures and spin-offs was accompanied by a higher incidence of leaks as well. Nearly a third (30 percent) of divestitures leaked in 2023, as opposed to 22 percent for transactions that involved the sale of an entire company.

Private equity deals were also slightly more likely to leak than the overall number—27 percent, compared to the overall 24 percent figure.

When it comes to where the most leaks show up, social media was the biggest source, accounting for 74 percent of what the report’s authors call “total reach” (an estimate of how many individuals may have seen a piece of content). Social media was also responsible for half of all online mentions.

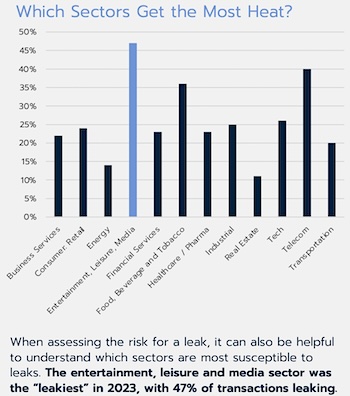

The most leak-likely sector? Entertainment, leisure and media, where 47 percent of transactions leaked. Telecom and food, beverage and tobacco were the next most likely to experience a leak, and real estate was the sector least likely to experience one.

The report has some advice for how stakeholders can control a leak. One, getting out ahead of any media leak is essential. “It’s critical to plan for a potential leak well in advance of due diligence and announcement day,” the report says. “Comprehensive preparation and close coordination coupled with a strong narrative and plan for communicating with key stakeholders continues to be the best way to position dealmakers for a successful announcement.”

The H/Advisors Abernathy study looked at deals where at least one of the parties to the deal is based in the US. A “leak” was defined as a deal-related media mention of bidder and/or target company names prior to company disclosure of deal negotations.

FGS Global represents private equity firm Thoma Bravo as it makes a $4.6B bid for Darktrace, a UK-based cybersecurity artificial intelligence firm.

FGS Global represents private equity firm Thoma Bravo as it makes a $4.6B bid for Darktrace, a UK-based cybersecurity artificial intelligence firm.

Edelman handles Viking Holdings, the river and ocean luxury cruise line that plans to raise $1B via an IPO priced in the $21 to $25 per share range.

Edelman handles Viking Holdings, the river and ocean luxury cruise line that plans to raise $1B via an IPO priced in the $21 to $25 per share range. Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management.

Teneo is handling the initial public offering of CVC Capital Partners, one of Europe’s largest private equity firms with nearly $200B in assets under management. Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield.

Brunswick Group represents Endeavor Group Holdings as it agrees to go private via its acquisition by Silver Lake technology investment firm, which is handled by Edelman Smithfield.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.