|

Nosediving technology spending, tumbling healthcare outlays and recession-jittery consumers jolted PR in 2023 as the 147 independent firms ranked by O’Dwyer’s posted a paltry 1.8 percent growth to a combined $4.7B in fee income.

That lackluster performance followed a robust 18.2 increase in 2022 and a 29.7 surge in 2021 as the nation emerged from the COVID-19 pandemic.

Ranked firms reported a 1 percent drop in total yearend 2023 employment to 22,856 people.

The Big Ten firms registered 1.5 percent growth to $3.1B and a 1 percent dip in workers to 15,151.

They were boosted by the debut of Avoq at the No. 10 position. Formed by the merger of Kivvit and Subject Matter, Avoq showed a 103.6 percent gain to $89.3M.

Edelman Retains Spot as PR’s Only $1B Firm

Despite a 3.7 percent dip in revenues to $1.04B, Edelman retained its crown as being PR’s only $1B firm.

The flagship US region accounted for much of Edelman’s revenues slippage as it registered a 9.1 percent drop in fee income to $639M.

|

| Richard Edelman |

The EMEA sector rebounded during 2023, rising 7.1 percent to $229M.

Latin America showed solid growth (+29.7 percent to $35M) while the APAC region inched ahead by 1.7 percent to $103M.

Canada was off 2.3 percent to $32M.

Edelman’s healthcare and technology practices struggled during the past year. They were down 12 percent and eight percent, respectively.

On the plus side: public affairs was up 19.5 percent, business-to-business rose 19 percent, food & beverage jumped 15.6 percent, and crisis increased 4.2 percent

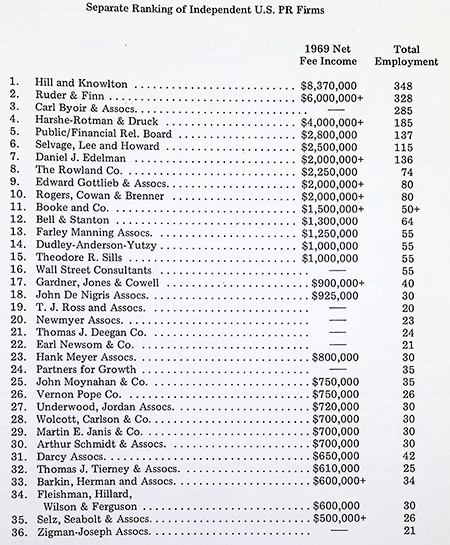

| O'Dwyer's first ranking of independent U.S. PR firms based on 1969 net fee income |

|

| Click to enlarge & save as a PDF |

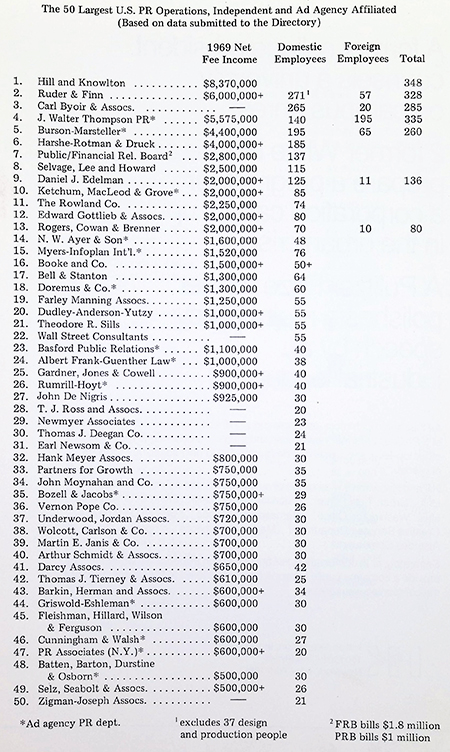

| 50 largest U.S. PR operations, independents and ad agency affiliated based on 1969 net fee income |

|

| Click to enlarge & save as a PDF |

Edelman released six Trust Barometer Reports in 2023 in the areas of healthcare equity, workplace trust, climate change, racial justice and consumer trust in brands.

The firm made a round of key hires during the year. They include Alex Thompson (global chair of corporate affairs and impact practices), Brian Buchwald (global head of product, trust data and technology).

Edelman upped Kirsty Graham (CEO, US), Ed Williams (president, international), Smita Reddy (global chair, food & beverage), Justin Westcott (global chair, technology), Radina Russell (head of US corporate), Julian Payne (global chair, crisis) and Margot Edelman (GM, New York)

Kivvit, Subject Matter Form Avoq

Kivvit and Subject Matter merged during 2023, which effectively doubled the size of their respective firms to revenues of $89.3M.

Rebranded as Avoq, the firm ranks as a Top 10 independent shop, offering strategic communications, issue advocacy and creative content services from its five office network staffed by about 220 employees.

|

| Nicole Cornish |

The new name speaks to the firm’s position as a national advocacy and communications firm that invokes thinking, evokes emotion and provokes action, according to CEO Nicole Cornish.

She said Avoq applies its unique combination of data-informed policy expertise, message strategy and content creation to motivate key stakeholders.

It works to elevate ideas, build brands and tackle reputational or policy challenges.

‘Starting with a channel-agnostic lens, while staying laser-focused on audience behaviors, we set strategy for a blended communications approach to break through the noise,” said Cornish.

Avoq maintained the executive leadership teams of its predecessor firms, including managing partners Steve Elmendorf, Paul Frick, Jimmy Ryan, Dan Sallick, and Eric Sedler.

RF Focuses on Growth Drivers

Ruder Finn CEO Kathy Bloomgarden guided her firm to 10 percent growth in fee income to the $175.5M during 2023.

A focus on three key drivers of growth sparked Ruder Finn’s upbeat financial performance.

|

| Kathy Bloomgarden |

Bloomgarden said the firm invigorated its pioneering TechLab designed to help companies identify and pilot new technologies for smarter engagement; transformed the agency into a fully integrated marketing shop focused on today’s business impact and challenges; and expanded its footprint and talent across tech-forward skill sets.

The New York-based firm, which has been in business for more than 75 years, doubled down on internal communications, crisis PR, generative AI and digital marketing to meet the growing needs of clients.

During 2023 and early 2024, Ruder Finn made three digital marketing acquisitions. They include Pandan Social (Malaysia), Atteline (United Arab Emirates) and Flightpath (New York).

Those acquisitions support the firm’s shift to a full-service integrated marketing consultancy and reinforce its strategic expansion by supporting the teams that it already has have in place.

“Ruder Finn has defined and redefined PR for over 75 years, shaping communications that moves industry-defining brands, companies, and leaders from what’s now to what’s next,” said Bloomgarden.

‘Historic Shutdown of Capital Markets’ Hurts ICR

ICR posted a 9.1 percent fee income decline to $146.2M in 2013 as it felt the impact of the historic shutdown of the capital markets, including IPOs and M&As.

CEO Tom Ryan said his firm continued to support the business communications needs of hundreds of companies across industry sectors and played a full role in consequential corporate situations and events.

|

| Tom Ryan |

“We applied considerable focus to strengthen and expand the ICR platform, completing three acquisitions during the year: Consilium, a European healthcare agency; Lumina, a Palo Alto-based, B2B tech PR firm; and Bullfrog + Baum, a consumer PR firm that was combined with ICR’s existing consumer PR team to form Blue Engine LLC,” said Ryan.

The acquisitions expanded ICR’s PR group to more than 180 staffers. The firm also introduced new and expanded offerings in the areas of investor access, ESG advisory, event management and crisis communications while further investing in critical data analytics and Generative AI capabilities.

ICR used 2023 to expand its global footprint, add new team members, and forged a more diversified service offering

“We are well positioned for 2024, particularly with the expected return of more normalized capital markets activity in latter part of the year,” said Ryan.

Finn Navigates Way through Tech Turbulence

Finn Partners was not immune to the shifts and turbulence in the technology sector, but its new client wins and expansion of existing relations helped stabilize the overall business, according to CEO Peter Finn.

The firm’s fee income dipped just 1.0 percent in 2023 to $195.4M as it added 175 new clients.

Finn’s fast-growing consumer segment picked up 36 new clients including Mazda, Country Archer, Kodiak Cakes, Nature’s Path, Oatly, Stag’s Leap Wine Cellars and Wild Planet.

|

| Peter Finn |

The firm’s sports portfolio grew with National Women’s Soccer League and USA Fencing.

Organically, Finn got boosts from Honeywell, 2K Games, IEEE, Little Caesars, World’s 50 Best Restaurants and Netscout.

Finn made three acquisitions to deepen its expertise and expand the global footprint.

Those pick-ups including: outre’ creative, a creative and digital design agency specializing in financial services; Hyderus, an international health-focused communications and policy firm; and C. Blohm & Associates, a PR and content marketing agency with expertise in B2B education and education technology.

With the increased business turbulence and volatility, Finn said his firm is a trusted counselor and creative steward to clients, helping them grow in a rapidly changing world.

“Our journey is a textbook case study in how creating a culture of shared values, delivering excellence for clients, and using our superpowers for good has proven to be the best formula for ongoing success,” he added.

Real Chemistry Benefits from AI Investments

Real Chemistry bucked the downward revenues trend in 2023 as its fee income rose 7 percent to $595M.

“The investments we’ve made in data and AI continue to outperform, as the pace of change accelerates toward digital and omnichannel engagement, said CEO Shankar Narayanan, CEO of Real Chemistry.

He said Real Chemistry’s precise targeting of healthcare providers and patients has become essential to pharmaceutical marketers.

|

| Shankar Narayanan |

“Our 5-year CAGR of 24% is testament to our ability to forge successful relationships with clients and continually expand how we work with them to bring their important therapies to patients and healthcare providers,” added Narayanan.

Real Chemistry acquired TI Health, a data-driven marketing and predictive analytics company that delivers omnichannel healthcare provider engagement, insights and activation solutions, during the past year.

In early 2024, it added Avant Healthcare to expand its medical communications capabilities across the entirety of the drug commercialization lifecycle.

Narayanan realigned Real Chemistry’s organizational structure into six key capability areas and best-in-class centers of expertise: activation, advertising, analytics and insights, integrated communications, medical and targeting.

He said that fits the firm’s “strategic vision – to provide best-in-class and fully integrated solutions for clients across the marketing and communications continuum.”

French|West|Vaughan Grows 7%

CEO Rick French led French|West|Vaughan to a 7 percent increase in 2023 fee income to $40.1M.

The firm benefited from new business wins and assignments from Guinness World Records, Crocs, Heaven Hill Distillery (Deep Eddy Vodka), Andrew Jackson Hermitage, Bahamas Ministry of Tourism, Taylor Sheridan’s Bosque Ranch Coffee, Pepsi Bottling Ventures, Steakhouse Elite, PureTalk Wireless (AT&T) and Natural Balance Pet Foods.

|

| Rick French |

F|W|V’s consumer marketing practice accounts for roughly 73% of the annual fee income in specialty areas such as apparel & fashion, food & beverage (including wine & spirits), destination marketing, entertainment and branded content, retail marketing, animal health & wellness, outdoor sports & leisure, and on-the-go lifestyle connectivity.

In 2023, French acquired Detroit-based The Millerschin Group, an automotive and manufacturing industry focused B2B PR firm; and sold CGPR, a Boston-area firm that it initially acquired in 2020.

The agency’s audited fee income does not include revenue from its Prix Productions longform content division, a $45M+ company that develops, co-finances and produces films, documentaries, and television series for a number of major Hollywood studios.

Stanton Punches Above its Weight

Stanton grew 5.5 percent to $11.1M as it added new financial clients to its roster, including Empower, The Connor Group, Leste Group, and Palm Tree Advisors.

The firm successfully executed its strategy to diversify its financial client base with solid wins across the real estate investment, financial consulting, private investment, retirement and wealth management sectors.

|

| Charlyn Lusk |

Stanton also led communications on more than 75 mergers, acquisitions and recapitalizations of businesses last year.

“The level of customer service and results that our team consistently delivers has made Stanton a partner of choice for financial brands, several of whom have worked with us for over a decade,” said Charlyn Lusk, managing director. “Clients know that we punch above our weight by bringing senior professionals and true strategy to every engagement, and they rely on us as an integral part of their team whose work helps achieve their business goals.”

Noting that Stanton is active in executing digital, design and marketing work, Lusk said the firm is well positioned to create a unified, seamless, client-centric experience across channels and activities for clients.

5WPR Bolsters its Brand

Co-CEOs Matt Caiola and Dara Busch led the New York-based 5WPR to two workplace awards—Ragan’s Top Workplaces in Communications list and Digiday WorkLife Employer of the Year Finalist— and launched a new digital agency, HOW.

An extension of the 5W brand, which was named after the five Ws of journalism: who, what, when, where and why, The HOW Agency strategically applies those continued principles of communication to the digital experience.

|

| Dara Busch, Matt Caiola |

“Every digital agency can pull together the same laundry list of services, but it’s the people running the show who will keep your brand fresh and spotless,” said Caiola.

The firm also expanded its executive team, welcoming executive VPs Jarrod Bull from Yard NYC and Robyn Wellikoff from Spectrum Science, as well as Cory Crayn and Kara Silverman who both returned to the agency from TodayTix Group and Clarity, respectively.

5WPR reported $61.6M in fees, which was down 2.1 percent, during its 21st year in business.

It added clients Royal Air Maroc, PatientFi, Turismo de Lisboa, and Skyscanner, and picked up business from legacy accounts like Webull and It’s A 10 Haircare.

Rise in Gross Billings Boosts Coyne PR

Coyne Public Relations slipped 4.2 percent to $37.4M during 2023 but the revenue shortfall was compensated by a $5.8M jump in gross billings.

CEO Tom Coyne attributes the billings growth to innovative expansions in integrations, influencer engagements, and a vibrant return to in-person events.

|

| Tom Coyne |

The New Jersey firm, which counts Hilton, Shell, Humana, Orangetheory Fitness, CeraVe and Pacira BioSciences as clients, collected about 50 PR industry awards in 2023.

The agency stepped up its commitment to nurturing talent via investment in Coyne College, an in-house educational initiative complemented by a comprehensive digital learning library.

“This initiative underscored a deep-rooted culture of continuous improvement and learning,” said Coyne.

Looking to 2024, Coyne PR is poised to continue advancing employee growth and employing data-driven strategies to navigate the ever-evolving PR landscape.

Coyne said his firm “is not just an agency; it’s a beacon of excellence in public relations.”

First Woman Takes Helm at G&S

G&S Business Communications used 2023 to carry out the planned CEO succession plan as Anne Green took over for Luke Lambert upon his retirement from the firm.

Green, who joined G&S in 2018 as part of its acquisition of CooperKatz, became the first woman to head the firm. She held the CEO slot at CooperKatz.

|

| Anne Green |

Green is now responsible for agency performance, operations, growth, innovation, culture and the continued evolution of its fully integrated suite of marketing and communications services.

Brian Hall was promoted to president, where he is in charge of client service; and KateThreewitts was upped to the shop’s first-ever chief people officer role.

Chief growth officer Steve Halsey completed his tenure as the global chair of Page Up, successfully leading the premier professional association for senior strategic communication leaders on its return to in-person events and programming post-pandemic.

G&S had a mixed year in terms of 2023 performance as fee income dipped 6.1 percent to $26.9M.

Clients tightened their budgets at the beginning of the year due to concerns about a possible recession.

The firm’s integrated communications offering opened up new opportunities, including significant growth in paid media activity to support client campaigns.

As 2023 closed out, G&S enjoyed some significant new business wins in the healthcare and the advanced manufacturing space.

Racepoint Global Weathers the Storm

Tech heavy Racepoint Global focused on weathering the storm in 2023 as net fee income fell 17.2 percent to $9.1M.

Early-year decisions by tech giants to cut costs created an industry-wide ripple effect, noted Bob Osmond, making it clear in Q1that 2023 was not going to be a year of financial growth.

“Our focus was on deepening existing client relationships, refining and expanding our offerings, and continuing to invest in building a rewarding employee experience,” he said.

|

| Bob Osmond |

Noting that Racepoint’s average client tenure remains at five years, Osmond said companies continue to entrust us to deliver more services across our portfolio, from executive thought leadership and owned content to live influencer and media events to visual content from RPG Studios.” Organic growth accounted for about 60 percent of new revenue during 2023.

Osmond said Racepoint added significant new clients in both embedded- and consumer-facing technology during the second half of the year.

The momentum carried into 2024 as the firm announced three new clients (EdgeCortix, indie Semiconductor and Sensera Systems) on March 26.

Osmond said 2024 is all about acceleration. “We are investing in new services and continued training and development for our people,” he said. “We believe our focus on culture is why our involuntary turnover rate remains in the low single digits.”

The Bliss Group Invests in Places, Products, People

The Bliss Group, which posted a 6.9 percent rise in revenues to $22.2M, used 2023 to focus on making a series of strategic investments in places, products and people.

The firm expanded its geographic footprint internationally, opening its first London office to provide best-in-class service to clients with a European presence across professional services, financial services, healthcare, and impact sectors.

|

| Cortney Stapleton |

“As the second largest financial services hub in the world and a growing center for healthcare innovation, London is a logical place for Bliss to deepen our presence and better support clients with an international footprint,” said Cortney Stapleton, CEO of Bliss. “We are excited to engage with new companies looking for creative ways to drive impact through insight while continuing to support our US-based partners.”

Bliss also partnered with Next Practices Group to launch Bliss Bio Health (BBH), a sister life sciences marketing agency. BBH aims to disrupt the healthcare ecosystem by integrating the science, patient experience, and business of health to create a real white space in healthcare and better remove the barriers to optimal care.

The foundation of Bliss’ insight-driven work was supported by the formation of its research & analytics team, which leverages proprietary research, analytics, brand strategy and award-winning innovations to better understand our clients and the audiences they serve.

Bliss also appointed Reed Handley, Alexis Odesser and Sally Slater as the agency’s first ever group of executive VPs, reflective of their deep expertise in growth, client service and innovation. The firm also named Ken Kerrigan as co-lead of the professional services practice.

Hoffman’s US Business Continues to Roll

While the The Hoffman Agency’s global growth slowed in 2023 to 1.5 percent to $26.7M, its U.S. operation increased by 11 percent.

From a base of $4.63M during the 2020 pandemic, THA has nearly doubled revenue in the U.S., landing at $8.67M last year.

|

| Lou Hoffman |

“More importantly, the firm has driven this hypergrowth without things breaking, as reflected in the 37 percent of revenue coming from clients who have engaged the agency for three years or longer,” said Lou Hoffman.

Key 2023 wins include Diligent, a multimarket program that covers the UK, France, Germany, Australia and Japan, with the U.S. team serving as the global hub.

A second noteworthy addition to the agency’s client portfolio is Georgia Tech University. "This engagement started with a McKinsey-like assignment to differentiate the engineering school and continued with an integrated communications campaign,” explained Hoffman.

Diligent and Georgia Tech join long-time THA anchor clients Nokia, Supermicro and TSMC.

Hoffman noted the firm’s talent branding and acquisition practice gained traction last year. New assignments included a recruitment campaign based on a microsite for the City of Fremont and a global Glassdoor campaign for a semiconductor client.

THA clients benefited from the launch of “The Story Studio,” which puts content resources—writers, designers, freelance talent, etc.—under one tent, reporting to the North America MD, Gerard LaFond.

This move builds upon the company’s “story is always there” mantra and its “Periodic Table of Business Storytelling” methodology.

It continues to reposition the Hoffman Agency as a firm that addresses pain points with paid, owned and earned media, according to Hoffman.

CG Life brand The Market Element is relaunched as Element CG... Gateway Group, a financial communications and digital media advisory firm, is bringing back its annual Gateway Conference... Firebrand launches what it says is an industry first: an integrated Account-Based Marketing and PR service.

CG Life brand The Market Element is relaunched as Element CG... Gateway Group, a financial communications and digital media advisory firm, is bringing back its annual Gateway Conference... Firebrand launches what it says is an industry first: an integrated Account-Based Marketing and PR service. RVD Communications, a New York-based PR, influencer marketing and brand building agency, is acquired by Band of Insiders... An NCSolutions consumer sentiment survey finds that 55 percent of respondents would be more likely to try a product if it’s marketed as being aligned with a healthier and more sustainable lifestyle... IPG Mediabrands launches its Climate Action Accelerator Program.

RVD Communications, a New York-based PR, influencer marketing and brand building agency, is acquired by Band of Insiders... An NCSolutions consumer sentiment survey finds that 55 percent of respondents would be more likely to try a product if it’s marketed as being aligned with a healthier and more sustainable lifestyle... IPG Mediabrands launches its Climate Action Accelerator Program. If your firm took part in O’Dwyer’s 2024 Rankings, there’s still time for it to appear in the profile section of our big May Rankings Issue.

If your firm took part in O’Dwyer’s 2024 Rankings, there’s still time for it to appear in the profile section of our big May Rankings Issue. Crowe PR is forming a strategic alliance with brand consultancy Movetic... SKDK founding partner Bill Knapp is inducted into the Association of Political Consultants Hall of Fame... SixSpeed, an independent creative marketing agency, acquires KC Truth, a media and creative shop.

Crowe PR is forming a strategic alliance with brand consultancy Movetic... SKDK founding partner Bill Knapp is inducted into the Association of Political Consultants Hall of Fame... SixSpeed, an independent creative marketing agency, acquires KC Truth, a media and creative shop.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.