|

Consumers—especially younger consumers—are still ready to spend, despite the effects of inflation, according to 5W Public Relations’ 2023 Consumer Culture Report, conducted in partnership with Censuswide, an independent market research consultancy.

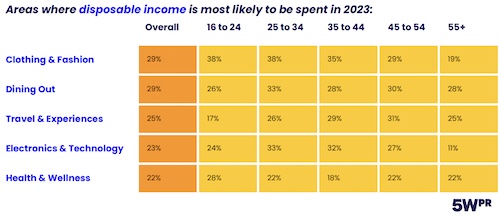

While saving money is still a priority, six out of 10 consumers (60 percent) said that they remain willing to spend disposable income “on goods and services beyond the necessary items,” with those between 25 and 44 being the most willing to splurge.

But that willingness to splurge does not extend equally across all categories. The most likely target for consumers’ more extravagant spending: electronics and tech-related purchases. Over half of respondents (51 percent) said that they’d be willing to splurge on those items this year, though that number is down from the 57 percent who said they’d be willing to shell out for them last year.

Health and wellness (43 percent) was the second-most-popular category, followed by home goods and furniture (42 percent) and dining out (40 percent).

|

A majority of respondents were also OK with paying for their splurges over time. But while 60 percent said that they take advantage of BNPL (buy now, pay later) features, only 11 percent said that the ability to spread out their payments impacts how much they spend by a lot. Once again, younger consumers (25 to 34) were more amenable to BNPL, with 80 percent saying that they take advantage of the feature.

When it comes to which channels can influence them to splurge on a purchase, three out of 10 said that word of mouth is a strong influence, with that number rising to four out of 10 for those between 25 and 35.

Paid ads on social media came in next, cited as an influential factor by one out of four shoppers, and “an influencer’s post on Instagram or TikTok” came in third.

But the desire to save remains, and consumers think that retailers can help with that through product discounts (cited by 50 percent of respondents) or waiving shipping fees (38 percent).

Censuswide surveyed 2,000 US consumers between November 21 and 24 of last year for the study.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms. Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem

Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX.

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX. AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack.

AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack. A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.