|

The power of Gen Z is becoming increasingly apparent across the marketing landscape, according to the newly released 2023 Edelman Trust Barometer.

Edelman’s “Special Report: The Collapse of the Purchase Funnel” looks at how changing attitudes toward trust and loyalty are re-shaping the traditional sales funnel, shifting its emphasis toward a long-term process of brand engagement and away from the “one and done” idea of a simple, straightforward transaction.

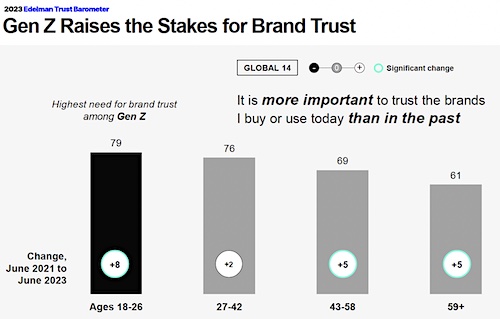

Gen Z consumers, the study finds, are leading the way in bringing about these changes. While the desire for trust in on the rise for consumers across the board, it is the highest for consumers between the ages of 18 and 26. Almost eight out of 10 study respondents in that age bracket (79 percent) agreed that “it is more important to trust the brands I buy or use today than in the past”—up eight percentage points from June 2021.

That percentage drops to 76 for consumers between 27 and 42, 69 for those between 43 and 58, and 61 for those 69 and over. While the numbers are up for all those groups, the rate of increase still lags considerably behind that of Gen Z.

|

Gen Z’s influence extends beyond trust and transparency-related issues, however. Close to seven out of 10 respondents (68 percent) said that when and where they shop was influenced by “teenagers and college-age people.” Not surprisingly, the group most influenced was those between 18 and 26. But even for those 59 and over, over half said that their purchasing habits were shaped by those of young shoppers.

The study’s results suggest that the growing need for trust grows out of a sense of insecurity as regards the world at large. About three-quarters (73 percent) of respondents said that they seek out brands “that increase my sense of safety and security” as opposed to sparking their sense of adventure.

That preference grows the further you get from the Gen Zers, but it remains relatively high for all ages. A whopping 83 percent of those 59 and over agreed, with 73 percent of those between 43 and 58, 69 percent of those from 27 to 42, and 67 percent of those from 18 to 26 following suit.

It also comes as all consumers are becoming more particular about getting the full story about the brands they buy and follow. More than half (58 percent) say they are now doing more research before they buy, the same number say they have cut down on impulse purchases, and almost seven out of 10 (68 percent) cite being more price-conscious.

It is also has made ongoing relationships between consumers and brands pivotal to the success of those brands. 79 percent of the survey respondents said that they “interact directly with brands, beyond using their products or service.”

One of central aspects of the consumer/brand relationship is the stands that brands take on current hot-button issues. While consumers say that taking a stand can often have a highly positive effect on their engagement with a brand (with an issue such as “improving healthcare access” making survey respondents seven times more likely buy a brand), brands would be well advised to proceed with caution. Differences between respondents of varying political persuasion can be pronounced, with a topic such as LGBTQ rights having a very different reaction for Republican and Democratic respondents.

Data for the 2023 Edelman Trust Barometer were gathered from May 1-12, from almost 14,000 respondents from countries including the US, UK, Japan, Brazil, Germany, UAE and India.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms. Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem

Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX.

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from Brodeur Partners, Interbrand and NewtonX. AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack.

AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack. A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.